• | the therapeutic potential and expected clinical benefits of KIMMTRAK; |

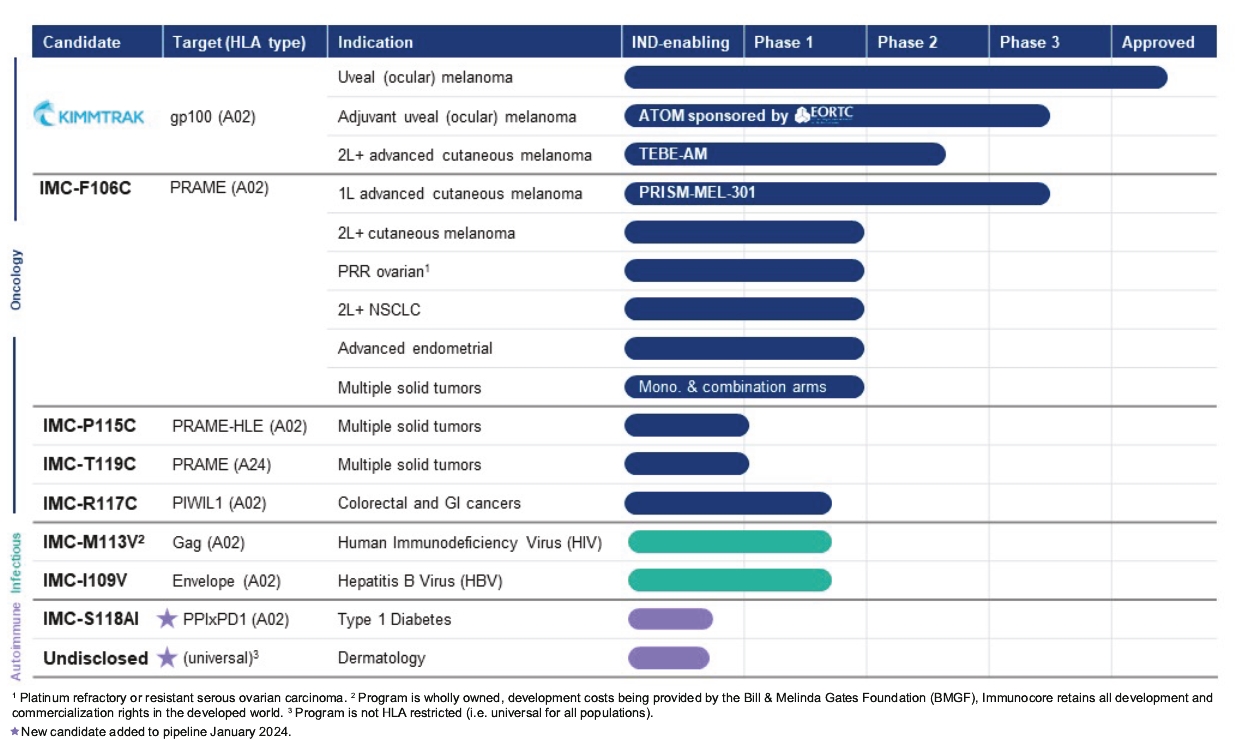

• | the safety, efficacy and clinical progress of our various ongoing clinical programs and any planned clinical programs, including those for tebentafusp, IMC-F106C, IMC-R117C, IMC-M113V, and IMC-I109V; |

• | our ability to continue to generate revenues, which is dependent upon maintaining significant market acceptance among physicians, patients and healthcare payors; |

• | our ability to maintain regulatory approval of KIMMTRAK for metastatic uveal melanoma, or mUM, in the United States, European Union and other territories, as well as our ability to obtain and maintain regulatory approval in additional indications, jurisdictions, and the timing thereof; |

• | our expectations regarding the continued commercialization and marketing of KIMMTRAK for mUM, including expanding into and the related timing of reaching patients in additional indications and territories; |

• | our ability to build a sustainable pipeline of new product candidates, including but not limited to future generations of KIMMTRAK and additional product candidates identified and developed using our ImmTAX platform; |

• | our ability to continue successfully executing our sales and marketing strategy of KIMMTRAK in the United States, Europe and elsewhere, including continuing to successfully recruit and retain sales and marketing personnel and to successfully build the market for our medicines; |

• | the rate and degree of market acceptance of our product candidates among physicians, patients, patient advocacy groups, third-party payors and the medical community and our ability and our distribution and marketing partners’ ability to obtain coverage and adequate reimbursement and pricing for our medicines from government and third-party payors and risks relating to the success of our patient assistance programs; |

• | the initiation, timing, progress and results of our ongoing clinical trials and any planned clinical trials, including the expansion arms of such trials, for tebentafusp in advanced melanoma and adjuvant uveal (or ocular) melanoma, IMC-F106C, IMC-P115C, IMC-T119C, IMC-R117C, IMC-M113V, and IMC-I109V, and our research and development programs, including delays or disruptions in clinical trials, non-clinical experiments and investigational new drug application-enabling studies; |

• | our estimates regarding the period of time for which our current capital resources will be sufficient to fund our continued operations, our future expenses, including the impact thereon of rising inflation, fluctuating exchange rates and other macroeconomic factors, and our future revenues and our needs for and ability to obtain additional financing; |

• | our expectations regarding timing of regulatory filings for, or our ability to obtain regulatory approval of, our product candidates other than KIMMTRAK; |

• | our ability to obtain accelerated approval for current and future product candidates from the U.S. Food and Drug Administration, or FDA, the European Commission, or other comparable regulatory authorities in other jurisdictions; |

• | our expectations regarding business disruptions affecting the initiation, patient enrollment, clinical trial site monitoring, development and operation of our current and proposed clinical trials, including as a result of a public health emergency or other global and macroeconomic factors, such as the war in Ukraine and the state of war between Hamas and Israel, global geopolitical tensions, supply chain disruptions, rising interest rates and rising inflation; |

• | our business strategies and goals; |

• | our plans to collaborate, or statements regarding our current collaborations, and our ability to find future partners and collaborators; |

• | the performance of our third-party suppliers and manufacturers, |

• | our expectations regarding our ability to obtain, maintain and enforce intellectual property protection for our product candidates and our ability to operate our business without infringing, misappropriating or otherwise violating the intellectual property rights of others; |

• | our expectations regarding competition with respect to KIMMTRAK or any of our other current or future product candidates, as well as innovations by current and future competitors in our industry; |

• | our expectations regarding regulatory developments in the United States and other countries, including potential changes in healthcare laws and regulations; |

• | our financial performance and our ability to effectively manage our anticipated growth; |

• | our ability to identify, recruit and retain qualified employees, including key commercial or management personnel; |

• | whether we are classified as a passive foreign investment company, or PFIC, for current and future periods; and |

• | any other factors discussed under the headings “Business,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our most recent Annual Report on Form 10-K and in our subsequent Quarterly Reports on Form 10-Q for the quarterly periods ended subsequent to our filing of such Annual Report on Form 10-K, as well as any amendments or updates to our risk factors reflected in subsequent filings with the SEC, which are incorporated by reference into this prospectus supplement and the accompanying base prospectus, together with other information in this prospectus supplement and the accompanying base prospectus, the other documents incorporated by reference herein and therein and any free writing prospectus that we may authorize. |

| | | Ordinary Shares Beneficially Owned Prior to Offering | | | Number of Ordinary Shares | | | Ordinary Shares Beneficially Owned After Offering | |||||||

Selling Shareholder | | | Number | | | Percent | | | Being Offered | | | Number | | | Percent |

Entities affiliated with Baker Bros. Advisors LP(1) | | | 4,134,595 | | | 8.3% | | | 1,220,063 | | | 2,914,532 | | | 5.9% |

(1) | Includes (i) 109,897 Ordinary Shares held in the form of ADS held directly by 667, L.P. (“667”) and (ii) 1,405,421 Ordinary Shares held |

• | ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

• | block trades in which the broker-dealer will attempt to sell the shares as agent, but may position and resell a portion of the block as principal to facilitate the transaction; |

• | purchases by a broker-dealer as principal and resale by the broker-dealer for its account; |

• | an exchange distribution in accordance with the rules of the applicable exchange; |

• | privately negotiated transactions; |

• | short sales effected after the date of this prospectus supplement; |

• | through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

• | broker-dealers may agree with the selling shareholders to sell a specified number of such shares at a stipulated price per share; |

• | a combination of any such methods of sale; and |

• | any other method permitted by applicable law. |

• | recognize or enforce judgments of U.S. courts obtained against us or our directors or officers predicated upon the civil liabilities provisions of the securities laws of the United States or any state in the United States; or |

• | entertain original actions brought in England and Wales against us or our directors or officers predicated upon the securities laws of the United States or any state in the United States. |

• | the relevant U.S. court had jurisdiction over the original proceedings according to English conflicts of laws principles at the time when proceedings were initiated; |

• | the claimant commenced proceedings in the courts of England and Wales and we were duly served with process; |

• | the U.S. judgment was final and conclusive on the merits in the sense of being final and unalterable in the court that pronounced it and being for a definite sum of money; |

• | the judgment given by the courts was not in respect of penalties, taxes, fines or similar fiscal or revenue obligations (or otherwise based on a U.S. law that an English court considers to relate to a penal, revenue or other public law), or for a declaration or injunction; |

• | the judgment was not procured by fraud; |

• | recognition or enforcement of the judgment in England and Wales would not be contrary to public policy or the Human Rights Act 1998; |

• | the proceedings pursuant to which judgment was obtained were not contrary to natural justice; |

• | the U.S. judgment was not arrived at by doubling, trebling or otherwise multiplying a sum assessed as compensation for the loss or damages sustained and not being otherwise in breach of Section 5 of the U.K. Protection of Trading Interests Act 1980, or is a judgment based on measures designated by the Secretary of State under Section 1 of that Act; |

• | there is not a prior decision of an English court or the court of another jurisdiction on the issues in question between the same parties; and |

• | the English enforcement proceedings were commenced within the limitation period. |

• | our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the SEC on February 28, 2024; |

• | our Current Reports on Form 8-K filed with the SEC on January 5, 2024 (excluding Items 2.02 and 7.01 therein), January 29, 2024 (excluding Item 2.02 therein) and February 2, 2024; and |

• | the description of our ADSs representing our ordinary shares contained in our Registration Statement on Form 8-A, as filed with the SEC under Section 12(b) of the Exchange Act on February 2, 2021, including any amendment or report filed for the purpose of updating such description (File No. 001-39992), including Exhibit 2.4 to our Annual Report on Form 20-F for the fiscal year ended December 31, 2020, filed with the SEC on March 25, 2021. |

• | the therapeutic potential and expected clinical benefits of KIMMTRAK; |

• | the safety, efficacy and clinical progress of our various ongoing clinical programs and any planned clinical programs, including those for tebentafusp, IMC-F106C, IMC-R117C, IMC-M113V, and IMC-I109V; |

• | our ability to continue to generate revenues, which is dependent upon maintaining significant market acceptance among physicians, patients and healthcare payors; |

• | our ability to maintain regulatory approval of KIMMTRAK for metastatic uveal melanoma, or mUM, in the United States, European Union and other territories, as well as our ability to obtain and maintain regulatory approval in additional indications, jurisdictions, and the timing thereof; |

• | our expectations regarding the continued commercialization and marketing of KIMMTRAK for mUM, including expanding into and the related timing of reaching patients in additional indications and territories; |

• | our ability to build a sustainable pipeline of new product candidates, including but not limited to future generations of KIMMTRAK and additional product candidates identified and developed using our ImmTAX platform; |

• | our ability to continue successfully executing our sales and marketing strategy of KIMMTRAK in the United States, Europe and elsewhere, including continuing to successfully recruit and retain sales and marketing personnel and to successfully build the market for our medicines; |

• | the rate and degree of market acceptance of our product candidates among physicians, patients, patient advocacy groups, third-party payors and the medical community and our ability and our distribution and marketing partners’ ability to obtain coverage and adequate reimbursement and pricing for our medicines from government and third-party payors and risks relating to the success of our patient assistance programs; |

• | the initiation, timing, progress and results of our ongoing clinical trials and any planned clinical trials, including the expansion arms of such trials, for tebentafusp in advanced melanoma and adjuvant uveal (or ocular) melanoma, IMC-F106C, IMC-P115C, IMC-T119C, IMC-R117C, IMC-M113V, and IMC-I109V, and our research and development programs, including delays or disruptions in clinical trials, non-clinical experiments and investigational new drug application-enabling studies; |

• | our estimates regarding the period of time for which our current capital resources will be sufficient to fund our continued operations, our future expenses, including the impact thereon of rising inflation, fluctuating exchange rates and other macroeconomic factors, and our future revenues and our needs for and ability to obtain additional financing; |

• | our expectations regarding timing of regulatory filings for, or our ability to obtain regulatory approval of, our product candidates other than KIMMTRAK; |

• | our ability to obtain accelerated approval for current and future product candidates from the U.S. Food and Drug Administration, or FDA, the European Commission, or other comparable regulatory authorities in other jurisdictions; |

• | our expectations regarding business disruptions affecting the initiation, patient enrollment, clinical trial site monitoring, development and operation of our current and proposed clinical trials, including as a result of a public health emergency or other global and macroeconomic factors, such as the war in Ukraine and the state of war between Hamas and Israel, global geopolitical tensions, supply chain disruptions, rising interest rates and rising inflation; |

• | our business strategies and goals; |

• | our plans to collaborate, or statements regarding our current collaborations, and our ability to find future partners and collaborators; |

• | the performance of our third-party suppliers and manufacturers, |

• | our expectations regarding our ability to obtain, maintain and enforce intellectual property protection for our product candidates and our ability to operate our business without infringing, misappropriating or otherwise violating the intellectual property rights of others; |

• | our expectations regarding competition with respect to KIMMTRAK or any of our other current or future product candidates, as well as innovations by current and future competitors in our industry; |

• | our expectations regarding regulatory developments in the United States and other countries, including potential changes in healthcare laws and regulations; |

• | our financial performance and our ability to effectively manage our anticipated growth; |

• | our ability to identify, recruit and retain qualified employees, including key commercial or management personnel; |

• | whether we are classified as a passive foreign investment company, or PFIC, for current and future periods; |

• | our anticipated use of any net proceeds from offerings of our securities under this prospectus; and |

• | any other factors discussed under the headings “Business,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our most recent Annual Report on Form 10-K and in our subsequent Quarterly Reports on Form 10-Q for the quarterly periods ended subsequent to our filing of such Annual Report on Form 10-K, as well as any amendments or updates to our risk factors reflected in subsequent filings with the SEC, which are incorporated by reference into this prospectus, together with other information in this prospectus, the documents incorporated by reference, any prospectus supplement and any free writing prospectus that we may authorize. |

• | a fixed price or prices, which may be changed from time to time; |

• | market prices prevailing at the time of sale; |

• | prices related to the prevailing market prices; or |

• | negotiated prices. |

• | the purchase by an institution of the securities covered under that contract shall not at the time of delivery be prohibited under the laws of the jurisdiction to which that institution is subject; and |

• | if the securities are also being sold to underwriters acting as principals for their own account, the underwriters shall have purchased such securities not sold for delayed delivery. The underwriters and other persons acting as our agents will not have any responsibility in respect of the validity or performance of delayed delivery contracts. |

• | each holder of our ordinary shares is entitled to one vote per ordinary share on all matters to be voted on by shareholders generally; |

• | the holders of the ordinary shares shall be entitled to receive notice of, attend, speak and vote at our general meetings; and |

• | the holders of our ordinary shares are entitled to receive such dividends as are recommended by our directors and declared by our shareholders. |

• | the deferred shares shall not be entitled to any dividends or to any other right of participation in the income or profits of the Company; |

• | on the return of assets on a winding-up of the Company, the deferred shares shall confer on the holders thereof an entitlement to receive out of the assets of the Company available for distribution amongst the members (subject to the rights of any new class of shares with preferred rights) the amount paid up or |

• | the deferred shares do not entitle the holder thereof to receive notice of, or to attend, speak or vote at any general meeting, or be part of the quorum thereof as the holders of the deferred shares; and |

• | the Company shall have irrevocable authority from each holder of deferred shares to either (i) appoint any person to execute on behalf of any holder of deferred shares a transfer of all or any of those shares and/or an agreement to transfer the same (without making any payment for them) to such person or persons as the Company may determine and to execute any other documents which such person may consider necessary or desirable to effect such transfer, in each case without obtaining the sanction of the holder(s) and without any payment being made in respect of such acquisition; and (ii) to purchase all or any of the deferred shares without obtaining the consent of the holders of those shares in consideration for an amount not exceeding £1.00 in respect of all the deferred shares then being purchased. |

• | a holder of non-voting ordinary shares shall, in relation to the non-voting ordinary shares held by him or her, have no right to receive notice of, or to attend or vote at, any general meeting of shareholders save in relation to a variation of class rights of the non-voting ordinary shares; |

• | the non-voting ordinary shares shall be re-designated as ordinary shares by our board of directors, or a duly authorized committee or representative thereof, upon delivery of a re-designation notice and otherwise subject to the terms and conditions set out therein. A holder of non-voting ordinary shares shall not be entitled to have any non-voting ordinary shares re-designated as ordinary shares where such re-designation would result in such holder thereof beneficially owning (for purposes of section 13(d) of the Exchange Act), when aggregated with “affiliates” and “group” members with whom such holder is required to aggregate beneficial ownership for purposes of section 13(d) of the Exchange Act, in excess of 9.99 per cent. of any class of securities of the Company registered under the Exchange Act (which percentage may be increased or decreased on a holder-by-holder basis subject to the provisions set out therein); and |

• | the non-voting ordinary shares shall be re-designated as ordinary shares automatically upon transfer of a non-voting ordinary share by its holder to any person that is not an “affiliate” or “group member” with whom such holder is required to aggregate beneficial ownership for purposes of section 13(d) of the Exchange Act. This automatic re-designation shall only be in respect of the non-voting ordinary shares that are subject to such transfer. |

• | the name of any person, without sufficient cause, is wrongly entered in or omitted from our register of members; or |

• | there is a default or unnecessary delay in entering on the register the fact of any person having ceased to be a member or on which we have a lien, provided that such refusal does not prevent dealings in the shares taking place on an open and proper basis. |

• | any resolution put to the vote of a general meeting must be decided exclusively on a poll; on a poll, every shareholder who is present in person or by proxy or corporate representative shall have one vote for each share of which they are the holder. A shareholder entitled to more than one vote need not, if they vote, use all their votes or cast all the votes in the same way; and |

• | if two or more persons are joint holders of a share, then in voting on any question the vote of the senior who tenders a vote, whether in person or by proxy, shall be accepted to the exclusion of the votes of the other joint holders. For this purpose seniority shall be determined by the order in which the names of the holders stand in the share register. |

• | it is for a share which is fully paid up; |

• | it is for a share upon which we have no lien; |

• | it is only for one class of share; |

• | it is in favor of a single transferee or no more than four joint transferees; |

• | it is duly stamped or is duly certificated or otherwise shown to the satisfaction of the board to be exempt from stamp duty (if this is required); and |

• | it is delivered for registration to our registered office (or such other place as the board may determine), accompanied (except in the case of a transfer by a person to whom we are not required by law to issue a certificate and to whom a certificate has not been issued or in the case of a renunciation) by the certificate for the shares to which it relates and such other evidence as the board may reasonably require to prove the title of the transferor (or person renouncing) and the due execution of the transfer or renunciation by him or, if the transfer or renunciation is executed by some other person on his behalf, the authority of that person to do so. |

• | the quorum for such class meeting shall be two holders in person or by proxy representing not less than one-third in nominal value of the issued shares of the class (excluding any shares held in treasury); and |

• | if at any adjourned meeting of such holders a quorum is not present at the meeting, one holder of shares of the class present in person or by proxy at an adjourned meeting constitutes a quorum. |

• | the giving of any guarantee, security or indemnity in respect of money lent or obligations incurred by him or by any other person at the request of or for the benefit of our company or any of our subsidiary undertakings; |

• | the giving of any guarantee, security or indemnity in respect of a debt or obligation of our company or any of our subsidiary undertakings for which he himself has assumed responsibility in whole or in part under a guarantee or indemnity or by the giving of security; |

• | any proposal or contract relating to an offer of securities of or by our company or any of our subsidiary undertakings in which offer he is or may be entitled to participate as a holder of securities or in the underwriting or sub-underwriting of which he is to participate; |

• | any arrangement involving any other company if the director (together with any person connected with him) has an interest of any kind in that company (including an interest by holding any position in that company or by being a member of that company), unless he is to his knowledge (either directly or indirectly) the holder of or beneficially interested in one per cent or more of any class of the equity share capital of that company (calculated exclusive of any shares of that class in that company held as treasury shares) or of the voting rights available to members of that company; |

• | any arrangement for the benefit of employees of our company or any of our subsidiary undertakings which only gives him benefits which are also generally given to employees to whom the arrangement relates; |

• | any contract relating to insurance which our company is to buy or renew for the benefit of the directors or a group of people which includes directors; and |

• | a contract relating to a pension, superannuation or similar scheme or a retirement, death, disability benefits scheme or employees’ share scheme which gives the director benefits which are also generally given to the employees to whom the scheme relates. |

• | any person, together with persons acting in concert with him, acquires, whether by a series of transactions over a period of time or not, an interest in shares which (taken together with shares in which he is already interested, and in which persons acting in concert with him are interested) carry 30% or more of the voting rights of a company; or |

• | any person who, together with persons acting in concert with him, is interested in shares which in the aggregate carry not less than 30% of the voting rights of a company but does not hold shares carrying more than 50% of such voting rights and such person, or any person acting in concert with him, acquires an interest in any other shares which increases the percentage of shares carrying voting rights in which he is interested, |

• | in respect of the default shares, the relevant shareholder shall not be entitled to vote (either in person or by representative or proxy) at any general meeting or to exercise any other right conferred by a shareholding in relation to general meetings; and |

• | where the default shares represent at least 0.25% in nominal value of the issued shares of their class, (a) any dividend or other money payable in respect of the default shares shall be retained by us without liability to pay interest and/or (b) no transfers by the relevant shareholder of any default shares may be registered (unless the shareholder himself is not in default and the shareholder provides a certificate, in a form satisfactory to the directors, to the effect that after due and careful enquiry the shareholder is satisfied that none of the shares to be transferred are default shares). |

• | if, at the time that the distribution is made, the amount of its net assets (that is, the total excess of assets over liabilities) is not less than the total of its called up share capital and undistributable reserves; and |

• | if, and to the extent that, the distribution itself, at the time that it is made, does not reduce the amount of the net assets to less than that total. |

| | | ENGLAND & WALES | | | DELAWARE | |

Number of Directors | | | Under the Companies Act, a public limited company must have at least two directors and the number of directors may be fixed by or in the manner provided in a company’s articles of association. | | | Under Delaware law, a corporation must have at least one director and the number of directors shall be fixed by or in the manner provided in the bylaws. |

| | | | | |||

Removal of Directors | | | Under the Companies Act, shareholders may remove a director without cause by an ordinary resolution (which is passed by a simple majority of those voting in person or by proxy at a general meeting) irrespective of any provisions of any service contract the director has with the company, provided 28 clear days’ notice of the resolution has been given to the company and its shareholders. On receipt of notice of an intended resolution to remove a director, the company must forthwith send a copy of the notice to the director concerned. Certain other procedural requirements under the Companies Act must also be followed, such as allowing the director to make representations against his or her removal either at the meeting or in writing. | | | Under Delaware law, any director or the entire board of directors may be removed, with or without cause, by the holders of a majority of the shares then entitled to vote at an election of directors, except (i) unless the certificate of incorporation provides otherwise, in the case of a corporation whose board of directors is classified, stockholders may effect such removal only for cause, or (ii) in the case of a corporation having cumulative voting, if less than the entire board of directors is to be removed, no director may be removed without cause if the votes cast against his removal would be sufficient to elect him if then cumulatively voted at an election of the entire board of directors, or, if there are classes of directors, at an election of the class of directors of which he is a part. |

| | | | | |||

Vacancies on the Board of Directors | | | Under English law, the procedure by which directors, other than a company’s initial directors, are appointed is generally set out in a company’s articles of association, provided that where two or more persons are appointed as directors of a public limited company by resolution of the shareholders, resolutions appointing each director must be voted on individually. | | | Under Delaware law, vacancies and newly created directorships may be filled by a majority of the directors then in office (even though less than a quorum) or by a sole remaining director unless (i) otherwise provided in the certificate of incorporation or bylaws of the corporation or (ii) the certificate of incorporation directs that a particular class of stock is to elect such director, in which case a majority of the other directors elected by such class, or a sole remaining director elected by such class, will fill such vacancy. |

| | | | | |||

Annual General Meeting | | | Under the Companies Act, a public limited company must hold an annual general meeting in each six-month period following the company’s annual accounting reference date. | | | Under Delaware law, the annual meeting of stockholders shall be held at such place, on such date and at such time as may be designated from time to time by the board of directors or as provided in the certificate of incorporation or by the bylaws. |

| | | | |

| | | ENGLAND & WALES | | | DELAWARE | |

General Meeting | | | Under the Companies Act, a general meeting of the shareholders of a public limited company may be called by the directors. Shareholders holding at least 5% of the paid-up capital of the company carrying voting rights at general meetings (excluding any paid up capital held as treasury shares) can require the directors to call a general meeting and, if the directors fail to do so within a certain period, may themselves convene a general meeting. | | | Under Delaware law, special meetings of the stockholders may be called by the board of directors or by such person or persons as may be authorized by the certificate of incorporation or by the bylaws. |

| | | | | |||

Notice of General Meetings | | | Under the Companies Act, at least 21 clear days’ notice must be given for an annual general meeting and any resolutions to be proposed at the meeting. Subject to a company’s articles of association providing for a longer period, at least 14 clear days’ Notice is required for any other general meeting of a public limited company. In addition, certain matters, such as the removal of directors or auditors, require special notice, which is 28 clear days’ notice. The shareholders of a company may in all cases consent to a shorter notice period, the proportion of shareholders’ consent required being 100% of those entitled to attend and vote in the case of an annual general meeting and, in the case of any other general meeting, a majority in number of the members having a right to attend and vote at the meeting, being a majority who together hold not less than 95% in nominal value of the shares giving a right to attend and vote at the meeting. | | | Under Delaware law, unless otherwise provided in the certificate of incorporation or bylaws, written notice of any meeting of the stockholders must be given to each stockholder entitled to vote at the meeting not less than ten nor more than 60 days before the date of the meeting and shall specify the place, date, hour and purpose or purposes of the meeting. |

| | | | | |||

Quorum | | | Subject to the provisions of a company’s articles of association, the Companies Act provides that two shareholders present at a meeting (in person, by proxy or authorized representative under the Companies Act) shall constitute a quorum for companies with more than one member. | | | The certificate of incorporation or bylaws may specify the number of shares, the holders of which shall be present or represented by proxy at any meeting in order to constitute a quorum, but in no event shall a quorum consist of less than one third of the shares entitled to vote at the meeting. In the absence of such specification in the certificate of incorporation or bylaws, a majority of the shares entitled to vote, present in person or represented by proxy, shall constitute a quorum at a meeting of stockholders. |

| | | | | |||

Proxy | | | Under the Companies Act, at any meeting of shareholders, a shareholder may designate another person to attend, speak and vote at the meeting on their behalf by proxy. | | | Under Delaware law, at any meeting of stockholders, a stockholder may designate another person to act for such stockholder by proxy, but no such proxy shall be voted or acted upon after three years from its date, unless the |

| | | ENGLAND & WALES | | | DELAWARE | |

| | | | | proxy provides for a longer period. A director of a Delaware corporation may not issue a proxy representing the director’s voting rights as a director. | ||

| | | | | |||

Preemptive Rights | | | Under the Companies Act, “equity securities,” being (i) shares in the company other than shares that, with respect to dividends and capital, carry a right to participate only up to a specified amount in a distribution, referred to as “ordinary shares,” or (ii) rights to subscribe for, or to convert securities into, ordinary shares, proposed to be allotted for cash must be offered first to the existing equity shareholders in the company in proportion to the respective nominal value of their holdings, unless an exception applies or a special resolution to the contrary has been passed by shareholders in a general meeting or the articles of association provide otherwise in each case in accordance with the provisions of the Companies Act. | | | Under Delaware law, shareholders have no preemptive rights to subscribe to additional issues of stock or to any security convertible into such stock unless, and except to the extent that, such rights are expressly provided for in the certificate of incorporation. |

| | | | | |||

Authority to Allot | | | Under the Companies Act, the directors of a company must not allot shares or grant rights to subscribe for or convert any security into shares unless an exception applies or an ordinary resolution to the contrary has been passed by shareholders in a general meeting or the articles of association provide otherwise, in each case in accordance with the provisions of the Companies Act. | | | Under Delaware law, if the corporation’s charter or certificate of incorporation so provides, the board of directors has the power to authorize the issuance of stock. The board may authorize capital stock to be issued for consideration consisting of cash, any tangible or intangible property or any benefit to the corporation or any combination thereof. It may determine the amount of such consideration by approving a formula. In the absence of actual fraud in the transaction, the judgment of the directors as to the value of such consideration is conclusive. |

| | | | | |||

Liability of Directors and Officers | | | Under the Companies Act, any provision, whether contained in a company’s articles of association or any contract or otherwise, that purports to exempt a director of a company, to any extent, from any liability that would otherwise attach to him in connection with any negligence, default, breach of duty or breach of trust in relation to the company, is void. Any provision by which a company directly or indirectly provides an indemnity, to any extent, for a director of the company or of an associated company against any liability attaching to him in | | | Under Delaware law, a corporation’s certificate of incorporation may include a provision eliminating or limiting the personal liability of a director to the corporation and its stockholders for damages arising from a breach of fiduciary duty as a director. However, no provision can limit the liability of a director for: • any breach of the director’s duty of loyalty to the corporation or its stockholders; • acts or omissions not in good faith or that involve intentional misconduct or a knowing violation of law; |

| | | ENGLAND & WALES | | | DELAWARE | |

| | | connection with any negligence, default, breach of duty or breach of trust in relation to the company of which he is a director is also void except as permitted by the Companies Act, which provides exceptions for the company to (i) purchase and maintain insurance against such liability; (ii) provide a “qualifying third party indemnity,” or an indemnity against liability incurred by the director to a person other than the company or an associated company or criminal proceedings in which he is convicted; and (iii) provide a “qualifying pension scheme indemnity,” or an indemnity against liability incurred in connection with the company’s activities as trustee of an occupational pension plan. | | | • intentional or negligent payment of unlawful dividends or stock purchases or redemptions; or • any transaction from which the director derives an improper personal benefit. | |

| | | | | |||

Voting Rights | | | Under English law, unless a poll is demanded by the shareholders of a company or is required by the chairman of the meeting or the company’s articles of association, shareholders shall vote on all resolutions on a show of hands. Under the Companies Act, a poll may be demanded by (i) not fewer than five shareholders having the right to vote on the resolution; (ii) any shareholder(s) representing not less than 10% of the total voting rights of all the shareholders having the right to vote on the resolution (excluding any voting rights attaching to treasury shares); or (iii) any shareholder(s) holding shares in the company conferring a right to vote on the resolution (excluding any voting rights attaching to treasury shares) being shares on which an aggregate sum has been paid up equal to not less than 10% of the total sum paid up on all the shares conferring that right. A company’s articles of association may provide more extensive rights for shareholders to call a poll. Under English law, an ordinary resolution is passed on a show of hands if it is approved by a simple majority (more than 50%) of the votes cast by shareholders present (in person or by proxy) and entitled to vote. If a poll is demanded, an ordinary resolution is passed if it is approved by holders representing a simple majority of the total voting rights of shareholders present, in person or by proxy, who, being entitled to vote, vote on the resolution. Special | | | Delaware law provides that, unless otherwise provided in the certificate of incorporation, each stockholder is entitled to one vote for each share of capital stock held by such stockholder. |

| | | ENGLAND & WALES | | | DELAWARE | |

| | | resolutions require the affirmative vote of not less than 75% of the votes cast by shareholders present, in person or by proxy, at the meeting. If a poll is demanded, a special resolution is passed if it is approved by holders representing not less than 75% of the total voting rights of shareholders in person or by proxy who, being entitled to vote, vote on the resolution. | | | ||

| | | | | |||

Shareholder Vote on Certain Transactions | | | The Companies Act provides for schemes of arrangement, which are arrangements or compromises between a company and any class of shareholders or creditors and used in certain types of reconstructions, amalgamations, capital reorganizations or takeovers. These arrangements require: • the approval at a shareholders’ or creditors’ meeting convened by order of the court, of a majority in number of shareholders or creditors representing 75% in value of the capital held by, or debt owed to, the class of shareholders or creditors, or class thereof present and voting, either in person or by proxy; and • the approval of the court. | | | Generally, under Delaware law, unless the certificate of incorporation provides for the vote of a larger portion of the stock, completion of a merger, consolidation, sale, lease or exchange of all or substantially all of a corporation’s assets or dissolution requires: • the approval of the board of directors; and • the approval by the vote of the holders of a majority of the outstanding stock or, if the certificate of incorporation provides for more or less than one vote per share, a majority of the votes of the outstanding stock of the corporation entitled to vote on the matter. |

| | | | | |||

Standard of Conduct for Directors | | | Under English law, a director owes various statutory and fiduciary duties to the company, including: • to act in the way he considers, in good faith, would be most likely to promote the success of the company for the benefit of its members as a whole, and in doing so have regard (amongst other matters) to: (i) the likely consequences of any decision in the long-term, (ii) the interests of the company’s employees, (iii) the need to foster the company’s business relationships with suppliers, customers and others, (iv) the impact of the company’s operations on the community and the environment, (v) the desirability to maintain a reputation for high standards of business conduct, and (vi) the need to act fairly as between members of the company; | | | Delaware law does not contain specific provisions setting forth the standard of conduct of a director. The scope of the fiduciary duties of directors is generally determined by the courts of the State of Delaware. In general, directors have a duty to act without self-interest, on a well-informed basis and in a manner they reasonably believe to be in the best interest of the stockholders. Directors of a Delaware corporation owe fiduciary duties of care and loyalty to the corporation and to its shareholders. The duty of care generally requires that a director acts in good faith, with the care that an ordinarily prudent person would exercise under similar circumstances. Under this duty, a director must inform himself of all material information reasonably available regarding a significant transaction. The duty of loyalty requires that a director act in a manner he reasonably believes to be in the best interests of the corporation. He must not use his corporate position for personal gain or advantage. In general, but subject to certain exceptions, actions of a director are |

| | | ENGLAND & WALES | | | DELAWARE | |

| | | • to avoid a situation in which he has, or can have, a direct or indirect interest that conflicts, or possibly conflicts, with the interests of the company; • to act in accordance with the company’s constitution and only exercise his powers for the purposes for which they are conferred; • to exercise independent judgment; • to exercise reasonable care, skill and diligence; • not to accept benefits from a third party conferred by reason of his being a director or doing, or not doing, anything as a director; and • to declare any interest that he has, whether directly or indirectly, in a proposed or existing transaction or arrangement with the company. | | | presumed to have been made on an informed basis, in good faith and in the honest belief that the action taken was in the best interests of the corporation. However, this presumption may be rebutted by evidence of a breach of one of the fiduciary duties. Delaware courts have also imposed a heightened standard of conduct upon directors of a Delaware corporation who take any action designed to defeat a threatened change in control of the corporation. In addition, under Delaware law, when the board of directors of a Delaware corporation approves the sale or break-up of a corporation, the board of directors may, in certain circumstances, have a duty to obtain the highest value reasonably available to the shareholders. | |

| | | | | |||

Shareholder Litigation | | | Under English law, generally, the company, rather than its shareholders, is the proper claimant in an action in respect of a wrong done to the company or where there is an irregularity in the company’s internal management. Notwithstanding this general position, the Companies Act provides that (i) a court may allow a shareholder to bring a derivative claim (that is, an action in respect of and on behalf of the company) in respect of a cause of action arising from a director’s negligence, default, breach of duty or breach of trust and (ii) a shareholder may bring a claim for a court order where the company’s affairs have been or are being conducted in a manner that is unfairly prejudicial to some of its shareholders. | | | Under Delaware law, a stockholder may initiate a derivative action to enforce a right of a corporation if the corporation fails to enforce the right itself. The complaint must: • state that the plaintiff was a stockholder at the time of the transaction of which the plaintiff complains or that the plaintiff’s shares thereafter devolved on the plaintiff by operation of law; and • allege with particularity the efforts made by the plaintiff to obtain the action the plaintiff desires from the directors and the reasons for the plaintiff’s failure to obtain the action; or • state the reasons for not making the effort. |

| | | | | Additionally, the plaintiff must remain a stockholder through the duration of the derivative suit. The action will not be dismissed or compromised without the approval of the Delaware Court of Chancery. |

• | we do not timely request that the rights be distributed to you or we request that the rights not be distributed to you; |

• | we fail to deliver satisfactory documents to the depositary; or |

• | it is not reasonably practicable to distribute the rights. |

• | we do not request that the property be distributed to you or if we ask that the property not be distributed to you; |

• | we do not deliver satisfactory documents to the depositary; or |

• | the depositary determines that all or a portion of the distribution to you is not reasonably practicable. |

• | the ordinary shares are duly authorized, validly allotted and issued, fully paid, not subject to any call for the payment of further capital and legally obtained; |

• | all preemptive (and similar) rights, if any, with respect to such ordinary shares have been validly waived, disapplied or exercised; |

• | you are duly authorized to deposit the ordinary shares; |

• | the ordinary shares presented for deposit are free and clear of any lien, encumbrance, security interest, charge, mortgage or adverse claim, and are not, and the ADSs issuable upon such deposit will not be, “restricted securities” (as defined in the deposit agreement); and |

• | the ordinary shares presented for deposit have not been stripped of any rights or entitlements. |

• | ensure that the surrendered ADR is properly endorsed or otherwise in proper form for transfer; |

• | provide such proof of identity and genuineness of signatures, and of such other matters contemplated in the deposit agreement, as the depositary deems appropriate; |

• | comply with applicable laws and regulations, including regulations imposed by us and the depositary consistent with the deposit agreement, the ADR and applicable law; |

• | provide any transfer stamps required by the State of New York or the United States; and |

• | pay all applicable fees, charges, expenses, taxes and other government charges payable by ADR holders pursuant to the terms of the deposit agreement, upon the transfer of ADRs. |

• | temporary delays that may arise because (1) the transfer books for the ordinary shares or ADSs are closed, or (2) ordinary shares are immobilized on account of a shareholders’ meeting or a payment of dividends; |

• | obligations to pay fees, taxes and similar charges; or |

• | restrictions imposed because of laws or regulations applicable to ADSs or the withdrawal of securities on deposit. |

• | In the event of voting by show of hands, the depositary will vote (or cause the custodian to vote) all ordinary shares held on deposit at that time in accordance with the voting instructions received from a majority of holders of ADSs who provide timely voting instructions. |

• | In the event of voting by poll, the depositary will vote (or cause the custodian to vote) the ordinary shares held on deposit in accordance with the voting instructions received from the holders of ADSs. |

SERVICE | | | FEE |

Issuance of ADSs (e.g., an issuance of ADS upon a deposit of ordinary shares or upon a change in the ADS(s)-to-ordinary shares ratio, or for any other reason), excluding ADS issuances as a result of distributions of ordinary shares | | | Up to $0.05 per ADS issued |

| | | ||

Cancellation of ADSs (e.g., a cancellation of ADSs for delivery of deposited property or upon a change in the ADS(s)-to-ordinary shares ratio, or for any other reason) | | | Up to $0.05 per ADS cancelled |

| | | ||

Distribution of cash dividends or other cash distributions (e.g., upon a sale of rights and other entitlements) | | | Up to $0.05 per ADS held |

| | | ||

Distribution of ADSs pursuant to (i) share dividends or other distributions, or (ii) exercise of rights to purchase additional ADSs | | | Up to $0.05 per ADS held |

| | |

SERVICE | | | FEE |

Distribution of securities other than ADSs or rights to purchase additional ADSs (e.g., upon a spin-off) | | | Up to $0.05 per ADS held |

| | | ||

ADS Services | | | Up to $0.05 per ADS held on the applicable record date(s) established by the depositary |

| | | ||

Registration of ADS transfers (e.g., upon a registration of the transfer of registered ownership of ADSs, upon a transfer of ADSs into DTC and vice versa, or for any other reason). | | | Up to $0.05 per ADS transferred |

| | | ||

Conversion of ADSs of one series for ADSs of another series (e.g., upon conversion of Partial Entitlement ADSs for Full Entitlement ADSs, or upon conversion of Restricted ADSs into freely transferrable ADSs, and vice versa) | | | Up to $0.05 per ADS converted |

• | taxes (including applicable interest and penalties) and other governmental charges; |

• | the registration fees as may from time to time be in effect for the registration of ordinary shares on the share register and applicable to transfers of ordinary shares to or from the name of the custodian, the depositary or any nominees upon the making of deposits and withdrawals, respectively; |

• | certain cable, telex and facsimile transmission and delivery expenses; |

• | the expenses and other charges incurred by the depositary in the conversion of foreign currency; |

• | The fees and expenses incurred by the depositary in connection with compliance with exchange control regulations and other regulatory requirements applicable to ordinary shares, ADSs and ADRs; and |

• | the fees and expenses incurred by the depositary, the custodian or any nominee in connection with the servicing or delivery of deposited property. |

• | We and the depositary are obligated only to take the actions specifically stated in the deposit agreement without negligence or bad faith. |

• | The depositary disclaims any liability for any failure to carry out voting instructions, for any manner in which a vote is cast or for the effect of any vote, provided it acts in good faith and in accordance with the terms of the deposit agreement. |

• | The depositary disclaims any liability for any failure to accurately determine the lawfulness or practicality of any action, for the content of any document forwarded to you on our behalf or for the accuracy of any translation of such a document, for the investment risks associated with investing in ordinary shares, for the validity or worth of the ordinary shares, for any tax consequences that result from the ownership of ADSs or other deposited property, for the credit-worthiness of any third party, for allowing any rights to lapse under the terms of the deposit agreement, for the timeliness of any of our notices or for our failure to give notice or for any act or omission of or information provided by DTC or any DTC participant. |

• | The depositary shall not be liable for acts or omissions of any successor depositary in connection with any matter arising wholly after the resignation or removal of the depositary. |

• | We and the depositary will not be obligated to perform any act that is inconsistent with the terms of the deposit agreement. |

• | We and the depositary disclaim any liability if we or the depositary are prevented or forbidden from or subject to any civil or criminal penalty or restraint on account of, or delayed in, doing or performing any act or thing required by the terms of the deposit agreement, by reason of any provision, present or future of any law or regulation, including regulations of any stock exchange or by reason of present or future provisions of our articles of association, or any provision of or governing the securities on deposit, or by reason of any act of God or war or other circumstances beyond our or the depositary’s control. |

• | We and the depositary disclaim any liability by reason of any exercise of, or failure to exercise, any discretion provided for in the deposit agreement or in our articles of association or in any provisions of or governing the securities on deposit. |

• | We and the depositary further disclaim any liability for any action or inaction in reliance on the advice or information received from legal counsel, accountants, any person presenting ordinary shares for deposit, any holder of ADSs or authorized representatives thereof, or any other person believed by either of us in good faith to be competent to give such advice or information. |

• | We and the depositary also disclaim liability for the inability by any ADS holder or beneficiary owner to benefit from any distribution, offering, right or other benefit that is made available to holders of ordinary shares but is not, under the terms of the deposit agreement, made available to you. |

• | We and the depositary may rely without any liability upon any written notice, request or other document believed to be genuine and to have been signed or presented by the proper parties. |

• | We and the depositary also disclaim liability for any consequential or punitive damages for any breach of the terms of the deposit agreement. |

• | We and the depositary disclaim liability arising out of losses, liabilities, taxes, charges or expenses resulting from the manner in which a holder or beneficial owner of ADSs holds ADSs, including resulting from holding ADSs through a brokerage account. |

• | No disclaimer of any Securities Act liability is intended by any provision of the deposit agreement. |

• | Nothing in the deposit agreement gives rise to a partnership or joint venture, or establishes a fiduciary relationship, among us, the depositary and you as ADS holder. |

• | Nothing in the deposit agreement precludes Citibank (or its affiliates) from engaging in transactions in which parties adverse to us or the ADS owners have interests, and nothing in the deposit agreement obligates Citibank to disclose those transactions, or any information obtained in the course of those transactions, to us or to the ADS owners, or to account for any payment received as part of those transactions. |

• | Convert the foreign currency to the extent practical and lawful and distribute the U.S. dollars to the holders for whom the conversion and distribution is lawful and practical. |

• | Distribute the foreign currency to holders for whom the distribution is lawful and practical. |

• | Hold the foreign currency (without liability for interest) for the applicable holders. |

• | the title of the series of debt securities; |

• | any limit upon the aggregate principal amount that may be issued; |

• | the maturity date or dates; |

• | the form of the debt securities of the series; |

• | the applicability of any guarantees; |

• | whether or not the debt securities will be secured or unsecured, and the terms of any secured debt; |

• | whether the debt securities rank as senior debt, senior subordinated debt, subordinated debt or any combination thereof, and the terms of any subordination; |

• | if the price (expressed as a percentage of the aggregate principal amount thereof) at which such debt securities will be issued is a price other than the principal amount thereof, the portion of the principal amount thereof payable upon declaration of acceleration of the maturity thereof, or if applicable, the portion of the principal amount of such debt securities that is convertible into another security or the method by which any such portion shall be determined; |

• | the interest rate or rates, which may be fixed or variable, or the method for determining the rate and the date interest will begin to accrue, the dates interest will be payable and the regular record dates for interest payment dates or the method for determining such dates; |

• | our right, if any, to defer payment of interest and the maximum length of any such deferral period; |

• | if applicable, the date or dates after which, or the period or periods during which, and the price or prices at which, we may, at our option, redeem the series of debt securities pursuant to any optional or provisional redemption provisions and the terms of those redemption provisions; |

• | the date or dates, if any, on which, and the price or prices at which we are obligated, pursuant to any mandatory sinking fund or analogous fund provisions or otherwise, to redeem, or at the holder’s option to purchase, the series of debt securities and the currency or currency unit in which the debt securities are payable; |

• | the denominations in which we will issue the series of debt securities, if other than denominations of $1,000 and any integral multiple thereof; |

• | any and all terms, if applicable, relating to any auction or remarketing of the debt securities of that series and any security for our obligations with respect to such debt securities and any other terms which may be advisable in connection with the marketing of debt securities of that series; |

• | whether the debt securities of the series shall be issued in whole or in part in the form of a global security or securities; the terms and conditions, if any, upon which such global security or securities may be exchanged in whole or in part for other individual securities; and the depositary for such global security or securities; |

• | if applicable, the provisions relating to conversion or exchange of any debt securities of the series and the terms and conditions upon which such debt securities will be so convertible or exchangeable, including the conversion or exchange price, as applicable, or how it will be calculated and may be adjusted, any mandatory or optional (at our option or the holders’ option) conversion or exchange features, the applicable conversion or exchange period and the manner of settlement for any conversion or exchange; |

• | if other than the full principal amount thereof, the portion of the principal amount of debt securities of the series which shall be payable upon declaration of acceleration of the maturity thereof; |

• | additions to or changes in the covenants applicable to the particular debt securities being issued, including, among others, the consolidation, merger or sale covenant; |

• | additions to or changes in the events of default with respect to the securities and any change in the right of the trustee or the holders to declare the principal, premium, if any, and interest, if any, with respect to such securities to be due and payable; |

• | additions to or changes in or deletions of the provisions relating to covenant defeasance and legal defeasance; |

• | additions to or changes in the provisions relating to satisfaction and discharge of the indenture; |

• | additions to or changes in the provisions relating to the modification of the indenture both with and without the consent of holders of debt securities issued under the indenture; |

• | the currency of payment of debt securities if other than U.S. dollars and the manner of determining the equivalent amount in U.S. dollars; |

• | whether interest will be payable in cash or additional debt securities at our or the holders’ option and the terms and conditions upon which the election may be made; |

• | the terms and conditions, if any, upon which we will pay amounts in addition to the stated interest, premium, if any and principal amounts of the debt securities of the series to any holder that is not a “United States person” for federal tax purposes; |

• | any restrictions on transfer, sale or assignment of the debt securities of the series; and |

• | any other specific terms, preferences, rights or limitations of, or restrictions on, the debt securities, any other additions or changes in the provisions of the indenture, and any terms that may be required by us or advisable under applicable laws or regulations. |

• | if we fail to pay any installment of interest on any series of debt securities, as and when the same shall become due and payable, and such default continues for a period of 90 days; provided, however, that a valid extension of an interest payment period by us in accordance with the terms of any indenture supplemental thereto shall not constitute a default in the payment of interest for this purpose; |

• | if we fail to pay the principal of, or premium, if any, on any series of debt securities as and when the same shall become due and payable whether at maturity, upon redemption, by declaration or otherwise, or in any payment required by any sinking or analogous fund established with respect to such series; provided, however, that a valid extension of the maturity of such debt securities in accordance with the terms of any indenture supplemental thereto shall not constitute a default in the payment of principal or premium, if any; |

• | if we fail to observe or perform any other covenant or agreement contained in the debt securities or the indenture, other than a covenant specifically relating to another series of debt securities, and our failure continues for 90 days after we receive written notice of such failure, requiring the same to be remedied and stating that such is a notice of default thereunder, from the trustee or holders of at least 25% in aggregate principal amount of the outstanding debt securities of the applicable series; and |

• | if specified events of bankruptcy, insolvency or reorganization occur. |

• | the direction so given by the holder is not in conflict with any law or the applicable indenture; and |

• | subject to its duties under the Trust Indenture Act, the trustee need not take any action that might involve it in personal liability or might be unduly prejudicial to the holders not involved in the proceeding. |

• | the holder has given written notice to the trustee of a continuing event of default with respect to that series; |

• | the holders of at least 25% in aggregate principal amount of the outstanding debt securities of that series have made written request, |

• | such holders have offered to the trustee indemnity satisfactory to it against the costs, expenses and liabilities to be incurred by the trustee in compliance with the request; and |

• | the trustee does not institute the proceeding, and does not receive from the holders of a majority in aggregate principal amount of the outstanding debt securities of that series other conflicting directions within 90 days after the notice, request and offer. |

• | to cure any ambiguity, defect or inconsistency in the indenture or in the debt securities of any series; |

• | to comply with the provisions described above under “Description of Debt Securities—Consolidation, Merger or Sale;” |

• | to provide for uncertificated debt securities in addition to or in place of certificated debt securities; |

• | to add to our covenants, restrictions, conditions or provisions such new covenants, restrictions, conditions or provisions for the benefit of the holders of all or any series of debt securities, to make the occurrence, or the occurrence and the continuance, of a default in any such additional covenants, restrictions, conditions or provisions an event of default or to surrender any right or power conferred upon us in the indenture; |

• | to add to, delete from or revise the conditions, limitations, and restrictions on the authorized amount, terms, or purposes of issue, authentication and delivery of debt securities, as set forth in the indenture; |

• | to make any change that does not adversely affect the interests of any holder of debt securities of any series in any material respect; |

• | to provide for the issuance of and establish the form and terms and conditions of the debt securities of any series as provided above under “Description of Debt Securities—General” to establish the form of any certifications required to be furnished pursuant to the terms of the indenture or any series of debt securities, or to add to the rights of the holders of any series of debt securities; |

• | to evidence and provide for the acceptance of appointment under any indenture by a successor trustee; or |

• | to comply with any requirements of the SEC in connection with the qualification of any indenture under the Trust Indenture Act. |

• | extending the fixed maturity of any debt securities of any series; |

• | reducing the principal amount, reducing the rate of or extending the time of payment of interest, or reducing any premium payable upon the redemption of any series of any debt securities; or |

• | reducing the percentage of debt securities, the holders of which are required to consent to any amendment, supplement, modification or waiver. |

• | provide for payment; |

• | register the transfer or exchange of debt securities of the series; |

• | replace stolen, lost or mutilated debt securities of the series; |

• | pay principal of and premium and interest on any debt securities of the series; |

• | maintain paying agencies; |

• | hold monies for payment in trust; |

• | recover excess money held by the trustee; |

• | compensate and indemnify the trustee; and |

• | appoint any successor trustee. |

• | issue, register the transfer of, or exchange any debt securities of that series during a period beginning at the opening of business 15 days before the day of mailing of a notice of redemption of any debt securities that may be selected for redemption and ending at the close of business on the day of the mailing; or |

• | register the transfer of or exchange any debt securities so selected for redemption, in whole or in part, except the unredeemed portion of any debt securities we are redeeming in part. |

• | the specific designation and aggregate number of, and the price at which we will issue, the warrants; |

• | the currency or currency units in which the offering price, if any, and the exercise price are payable; |

• | the designation, amount and terms of the securities purchasable upon exercise of the warrants; |

• | if applicable, the exercise price for our ADSs and the number of ADSs to be received upon exercise; |

• | if applicable, the exercise price for our debt securities, the amount of debt securities to be received upon exercise, and a description of that series of debt securities; |

• | the date on which the right to exercise the warrants will begin and the date on which that right will expire or, if you may not continuously exercise the warrants throughout that period, the specific date or dates on which you may exercise the warrants; |

• | whether the warrants will be issued in fully registered form or bearer form, in definitive or global form or in any combination of these forms; |

• | any applicable material U.S. federal income tax consequences and any applicable material U.K. tax consequences; |

• | the identity of the warrant agent for the warrants and of any other depositaries, execution or paying agents, transfer agents, registrars or other agents; |

• | the proposed listing, if any, of the warrants or any securities purchasable upon exercise of the warrants on any securities exchange; |

• | if applicable, the date from and after which the warrants and the ADSs and/or debt securities will be separately transferable; |

• | if applicable, the minimum or maximum amount of the warrants that may be exercised at any one time; |

• | information with respect to book-entry procedures, if any; |

• | the anti-dilution provisions of the warrants, if any; |

• | any redemption or call provisions; and |

• | any additional terms of the warrants, including terms, procedures and limitations relating to the exchange and exercise of the warrants. |

• | recognize or enforce judgments of U.S. courts obtained against us or our directors or officers predicated upon the civil liabilities provisions of the securities laws of the United States or any state in the United States; or |

• | entertain original actions brought in England and Wales against us or our directors or officers predicated upon the securities laws of the United States or any state in the United States. |

• | the relevant U.S. court had jurisdiction over the original proceedings according to English conflicts of laws principles at the time when proceedings were initiated; |

• | the claimant commenced proceedings in the courts of England and Wales and we were duly served with process; |

• | the U.S. judgment was final and conclusive on the merits in the sense of being final and unalterable in the court that pronounced it and being for a definite sum of money; |

• | the judgment given by the courts was not in respect of penalties, taxes, fines or similar fiscal or revenue obligations (or otherwise based on a U.S. law that an English court considers to relate to a penal, revenue or other public law), or for a declaration or injunction; |

• | the judgment was not procured by fraud; |

• | recognition or enforcement of the judgment in England and Wales would not be contrary to public policy or the Human Rights Act 1998; |

• | the proceedings pursuant to which judgment was obtained were not contrary to natural justice; |

• | the U.S. judgment was not arrived at by doubling, trebling or otherwise multiplying a sum assessed as compensation for the loss or damages sustained and not being otherwise in breach of Section 5 of the U.K. Protection of Trading Interests Act 1980, or is a judgment based on measures designated by the Secretary of State under Section 1 of that Act; |

• | there is not a prior decision of an English court or the court of another jurisdiction on the issues in question between the same parties; and |

• | the English enforcement proceedings were commenced within the limitation period. |

• | our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the SEC on February 28, 2024; |

• | our Current Reports on Form 8-K filed with the SEC on January 5, 2024 (excluding Items 2.02 and 7.01 therein), January 29, 2024 (excluding Item 2.02 therein) and February 2, 2024; and |

• | the description of our ADSs representing our ordinary shares contained in our Registration Statement on Form 8-A, as filed with the SEC under Section 12(b) of the Exchange Act on February 2, 2021, including any amendment or report filed for the purpose of updating such description (File No. 001-39992), including Exhibit 2.4 to our Annual Report on Form 20-F for the fiscal year ended December 31, 2020, filed with the SEC on March 25, 2021. |