| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | |

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | |

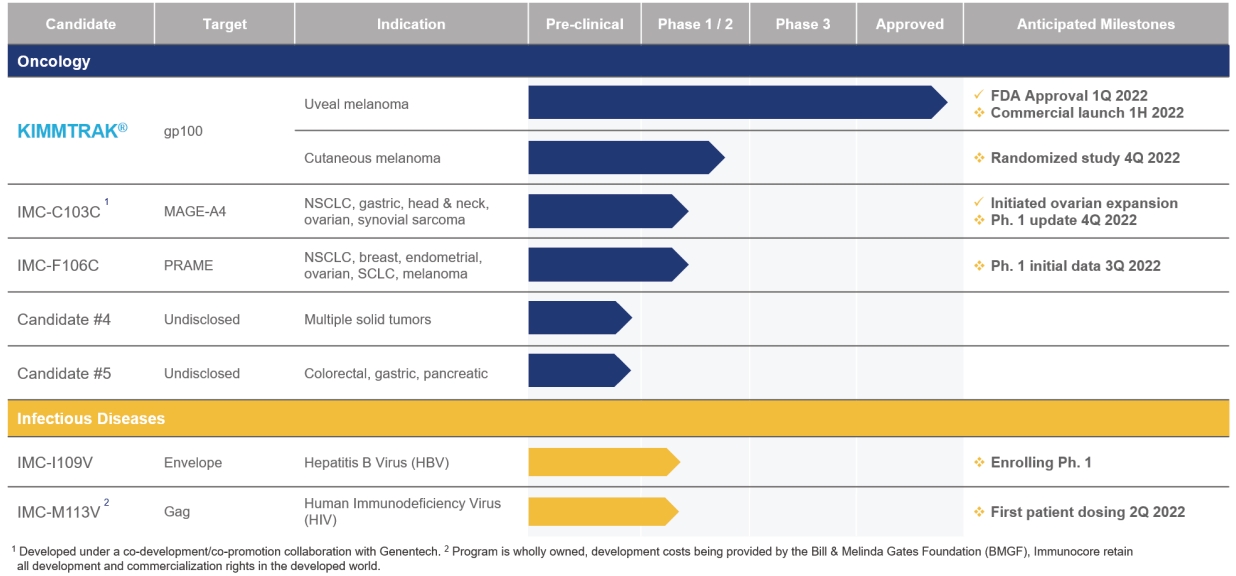

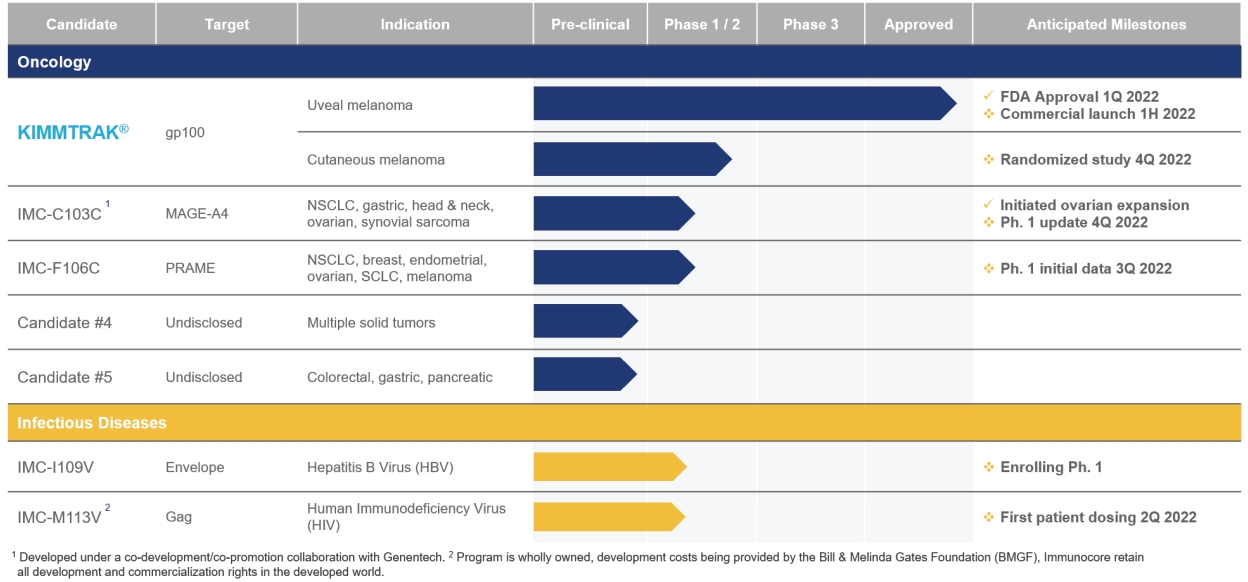

• | KIMMTRAK (tebentafusp-tebn), our ImmTAC molecule targeting an HLA-A*02:01 gp100 antigen, is our first approved product. We announced FDA approval of KIMMTRAK on January 26, 2022 for the treatment of HLA-A*02:01-positive adult patients with unresectable or mUM. KIMMTRAK demonstrated monotherapy activity and recently achieved the primary endpoint of superior overall survival in a randomized Phase 3 clinical trial in patients with previously untreated mUM against the investigator’s choice of treatment. The OS hazard ratio in the intent-to-treat population favored tebentafusp, HR=0.51 (95% CI: 0.37, 0.71); p< 0.0001, over investigator’s choice (82% pembrolizumab; 13% ipilimumab; 6% dacarbazine). The FDA reviewed KIMMTRAK under the Real-Time Oncology Review pilot program, an initiative of the FDA’s Oncology Center of Excellence designed to expedite the delivery of safe and effective cancer treatments to patients, and the FDA’s Project Orbis initiative, which enables concurrent review by the health authorities in partner countries that have requested participation. On April 1, 2022 the European Commission approved KIMMTRAK (tebentafusp-tebn) for the treatment of HLA-A*02:01-positive adult patients with unresectable or mUM. |

• | IMC-C103C, our ImmTAC molecule targeting an HLA-A*02:01 MAGE-A4 antigen, is currently being evaluated in a first-in-human, Phase 1/2 dose escalation clinical trial in patients with solid tumor cancers including non-small-cell lung cancer, or NSCLC, gastric, head and neck, ovarian and synovial sarcoma. In December 2021, we reported initial Phase 1 data from this trial at the European Society of Medical Oncology Immuno-Oncology Congress (ESMO-IO) 2021. Preliminary data from the trial showed that IMC-C103C promising clinical activity with confirmed durable responses in ovarian cancer and a confirmed durable response in head and neck squamous cell carcinoma, or HNSCC and demonstrated a manageable safety profile. We have initiated an expansion arm cohort of the ongoing trial for patients with high-grade serous ovarian carcinoma and plan to observe dosing at a level of 140 micrograms/week. We anticipate reporting additional data from the Phase 1 portion of the trial in the fourth quarter of 2022. |

• | IMC-F106C, our ImmTAC molecule targeting an optimal HLA-A*02:01 PRAME antigen is currently being evaluated in a first-in-human, Phase 1/2 dose escalation trial in patients with multiple solid tumor cancers including NSCLC, SCLC, endometrial, ovarian, cutaneous melanoma, and breast cancers. As of December 31, 2021, we enrolled 39 patients in the Phase 1 clinical trial. Early pharmacodynamic data indicates that IMC-F106C monotherapy is demonstrating biological activity at the dose levels currently under evaluation. We anticipate reporting Phase 1 initial data from the trial in the third quarter of 2022. |

• | IMC-I109V, our ImmTAV molecule targeting a conserved hepatitis B virus, or HBV, envelope antigen, is our most advanced ImmTAV program and is currently being evaluated in a Phase 1/2 clinical trial in patients with chronic HBV who are non-cirrhotic, hepatitis B e-Antigen negative, and virally suppressed on chronic nucleot(s)ide analogue therapy. Our goal is to develop a functional cure for HBV, and we dosed the first patient in our Phase 1 single ascending dose trial in the second quarter of 2021. |

• | IMC-M113V, our ImmTAV molecule targeting the human immunosuppression virus, or HIV, gag antigen bispecific TCR molecule, is currently in pre-clinical development. Our goal is to develop a functional cure for HIV. Our clinical trial application in the United Kingdom was accepted in December 2021, and we anticipate dosing the first patient in this trial during the second quarter of 2022. We plan to then expand the trial to Europe later in 2022. |

• | an exemption from compliance with any requirement that the Public Company Accounting Oversight Board may adopt regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements; |

• | reduced disclosure about our executive compensation arrangements; |

• | an exemption from the non-binding advisory votes on executive compensation, including golden parachute arrangements; and |

• | an exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002. |

• | the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations with respect to a security registered under the Exchange Act; |

• | the requirement to comply with Regulation Fair Disclosure, or Regulation FD, which regulates selective disclosure of material information; |

• | the sections of the Exchange Act requiring insiders to file public reports of their share ownership and trading activities and liability for insiders who profit from trades made in a short period of time; and |

• | the rules under the Exchange Act requiring the filing with the SEC of quarterly reports on Form 10-Q containing unaudited financial and other specified information, or current reports on Form 8-K upon the occurrence of specified significant events. |

• | our ability to maintain regulatory approval of KIMMTRAK (tebentafusp-tebn) for mUM in the United States; |

• | the timing of, and our ability to obtain and maintain regulatory approval of, KIMMTRAK in the European Union and respective European countries; |

• | our expectations regarding the potential commercialization of, the marketing and therapeutic potential of KIMMTRAK for mUM; |

• | our ability to build a sustainable pipeline of new medicine candidates, including but not limited to future generations of KIMMTRAK; |

• | the expected clinical benefits of KIMMTRAK including extended overall survival benefit; |

• | expectations regarding the timing of the commercial launch of KIMMTRAK, the timing of commercial availability and the ability to reach patients in a timely manner; |

• | the value proposition of KIMMTRAK in mUM and benefit as an orphan indication including expectations regarding the potential market size opportunity; |

• | our ability to successfully execute our sales and marketing strategy of KIMMTRAK in the United States, Europe and elsewhere, including continuing to successfully recruit and retain sales and marketing personnel and to successfully build the market for our medicines; |

• | our expectations about the willingness of healthcare providers to recommend KIMMTRAK to people with mUM; |

• | the rate and degree of market acceptance of our product candidates among physicians, patients, patient advocacy groups, third-party payors and the medical community and our ability and our distribution and marketing partners’ ability to obtain coverage and adequate reimbursement and pricing for, our medicines from government and third-party payers and risks relating to the success of our patient assistance programs; |

• | the market opportunities for our product candidates may be smaller than we estimate and any approval that we obtain may be based on a narrower definition of the patient population; |

• | the initiation, timing, progress and results of our current and future preclinical studies and clinical trials and related preparatory work and the period during which the results of the trials will become available, as well as our research and development programs; |

• | our estimates regarding expenses, future revenue, capital requirements and needs for additional financing; |

• | our expectations regarding timing of regulatory filings for, or our ability to obtain regulatory approval of, tebentafusp in additional jurisdictions, or any of our other product candidates; |

• | our ability to obtain accelerated approval for current and future product candidates from the FDA, EMA and MHRA; |

• | our ability to identify and develop additional product candidates using our ImmTAX platform; |

• | business disruptions affecting the initiation, patient enrollment, clinical trial site monitoring, development and operation of our current and proposed clinical trials, as well as commercialization of our products, including KIMMTRAK, including a public health emergency, such as the ongoing coronavirus 2019, or COVID-19, pandemic; |

• | the potential benefits of our product candidates; |

• | our business strategies and goals; |

• | our plans to collaborate, or statements regarding our current collaborations; |

• | our ability to find future partners and collaborators; |

• | the performance of our third-party suppliers and manufacturers, |

• | our expectations regarding our ability to obtain, maintain and enforce intellectual property protection for our product candidates and our ability to operate our business without infringing, misappropriating or otherwise violating the intellectual property rights of others; |

• | the effects of competition with respect to KIMMTRAK or any of our other current or future product candidates, as well as innovations by current and future competitors in our industry; |

• | regulatory developments in the United States and other countries, including potential changes in healthcare laws and regulations; |

• | our financial performance and our ability to effectively manage our anticipated growth; |

• | our ability to identify, recruit and retain qualified employees; |

• | the loss of key commercial or management personnel; |

• | whether we are classified as a PFIC for current and future periods; |

• | our ability to raise additional capital; and |

• | our estimates regarding the period of time for which our current capital resources will be sufficient to fund our continued operations, future expenses, revenues and needs for additional financing and the accuracy thereof. |

| | | Ordinary Shares Beneficially Owned Prior to Offering | | | Number of Ordinary Shares Being Offered | | | Ordinary Shares Beneficially Owned After Offering | |||||||

Selling Shareholder | | | Number | | | Percent | | | Number | | | Percent | |||

Entities affiliated with Baker Bros. Advisors LP(1) | | | 3,352,357 | | | 7.6% | | | 3,352,357 | | | — | | | — |

(1) | The information shown is based, in part, upon disclosures filed on a Schedule 13D on May 20, 2021 filed jointly by Baker Bros. Advisors LP (the “Adviser”), Baker Bros. Advisors (GP) LLC (the “Adviser GP”), Felix J. Baker and Julian C. Baker (collectively, the “Reporting Persons”). The number reported consists of 186,127 ADSs and 62,087 ordinary shares issuable upon conversion of 62,087 non-voting ordinary shares directly held by 667, L.P. (“667”) and 2,334,603 ADS and 769,540 ordinary shares issuable upon conversion of 769,540 non-voting ordinary shares directly held by Baker Brothers Life Sciences, L.P. (“Life Sciences”, and together with 667, the Baker Funds). The non-voting ordinary shares are only convertible on a 1-for-1 basis into ordinary shares to the extent that after giving effect to such conversion the holders thereof, their affiliates and any persons who are members of a Section 13(d) group with the holders or their affiliates would beneficially own in the aggregate, for purposes of Rule 13d-3 under the Securities Exchange Act of 1934, as amended, no more than 9.99% of the outstanding Ordinary Shares. The Adviser is the investment adviser to the Baker Funds and has the sole voting and investment power with respect to the securities held by the Baker Funds and thus may be deemed to beneficially own such securities. The Adviser GP is the sole general partner of the Adviser and thus may be deemed to beneficially own the securities held by the Baker Funds. The managing members of the Adviser GP are Julian C. Baker and Felix J. Baker, who may be deemed to beneficially own the securities held by the Baker Funds. Julian C. Baker, Felix J. Baker, the Adviser and the Adviser GP disclaim beneficial ownership of all shares held by the Baker Funds, except to the extent of their indirect pecuniary interest therein. The business address of the Adviser, the Adviser GP, Julian C. Baker and Felix J. Baker is 860 Washington Street, 3rd Floor, New York, NY 10014. |

• | ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

• | block trades in which the broker-dealer will attempt to sell the shares as agent, but may position and resell a portion of the block as principal to facilitate the transaction; |

• | purchases by a broker-dealer as principal and resale by the broker-dealer for its account; |

• | an exchange distribution in accordance with the rules of the applicable exchange; |

• | privately negotiated transactions; |

• | short sales effected after the date of this prospectus supplement; |

• | through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

• | broker-dealers may agree with the selling shareholders to sell a specified number of such shares at a stipulated price per share; |

• | a combination of any such methods of sale; and |

• | any other method permitted by applicable law. |

• | recognize or enforce judgments of U.S. courts obtained against us or our directors or officers predicated upon the civil liabilities provisions of the securities laws of the United States or any state in the United States; or |

• | entertain original actions brought in England and Wales against us or our directors or officers predicated upon the securities laws of the United States or any state in the United States. |

• | the relevant U.S. court had jurisdiction over the original proceedings according to English conflicts of laws principles at the time when proceedings were initiated; |

• | England and Wales courts had jurisdiction over the matter on enforcement and we either submitted to such jurisdiction or were resident or carrying on business within such jurisdiction and were duly served with process; |

• | the U.S. judgment was final and conclusive on the merits in the sense of being final and unalterable in the court that pronounced it and being for a definite sum of money; |

• | the judgment given by the courts was not in respect of penalties, taxes, fines or similar fiscal or revenue obligations (or otherwise based on a U.S. law that an English court considers to relate to a penal, revenue or other public law); |

• | the judgment was not procured by fraud; |

• | the judgment was not obtained following a breach of a jurisdictional or arbitrational clause, unless with the agreement of the defendant as the defendant’s subsequent submission to the jurisdiction of the court; |

• | recognition or enforcement of the judgment in England and Wales would not be contrary to public policy or the Human Rights Act 1998; |

• | the proceedings pursuant to which judgment was obtained were not contrary to natural justice; |

• | the U.S. judgment was not arrived at by doubling, trebling or otherwise multiplying a sum assessed as compensation for the loss or damages sustained and not being otherwise in breach of Section 5 of the U.K. Protection of Trading Interests Act 1980, or is a judgment based on measures designated by the Secretary of State under Section 1 of that Act; |

• | there is not a prior decision of an English court or the court of another jurisdiction on the issues in question between the same parties; and |

• | the English enforcement proceedings were commenced within the limitation period. |

• | our Annual Report on Form 20-F for the fiscal year ended December 31, 2021, filed with the SEC on March 3, 2022; |

• | our report on Form 6-K furnished to the SEC on January 26, 2022; and |

• | the description of our ADSs representing our ordinary shares contained in our Registration Statement on Form 8-A, as filed with the SEC under Section 12(b) of the Exchange Act on February 2, 2021, including any amendment or report filed for the purpose of updating such description (File No. 001-39992), including Exhibit 2.4 to our Annual Report on Form 20-F for the fiscal year ended December 31, 2020, filed with the SEC on March 25, 2021. |

• | KIMMTRAK (tebentafusp-tebn), our ImmTAC molecule targeting an HLA-A*02:01 gp100 antigen, is our first approved product. We announced FDA approval of KIMMTRAK on January 26, 2022 for the treatment of HLA-A*02:01-positive adult patients with unresectable or mUM. KIMMTRAK demonstrated monotherapy activity and recently achieved the primary endpoint of superior overall survival in a randomized Phase 3 clinical trial in patients with previously untreated mUM against the investigator’s choice of treatment. The OS hazard ratio in the intent-to-treat population favored tebentafusp, HR=0.51 (95% CI: 0.37, 0.71); p< 0.0001, over investigator’s choice (82% pembrolizumab; 13% ipilimumab; 6% dacarbazine). The FDA reviewed KIMMTRAK under the Real-Time Oncology Review pilot program, an initiative of the FDA’s Oncology Center of Excellence designed to expedite the delivery of safe and effective cancer treatments to patients, and the FDA’s Project Orbis initiative, which enables concurrent review by the health authorities in partner countries that have requested participation. On April 1, 2022 the European Commission approved KIMMTRAK (tebentafusp-tebn) for the treatment of HLA-A*02:01-positive adult patients with unresectable or mUM. |

• | IMC-C103C, our ImmTAC molecule targeting an HLA-A*02:01 MAGE-A4 antigen, is currently being evaluated in a first-in-human, Phase ½ dose escalation clinical trial in patients with solid tumor cancers including non-small-cell lung cancer, or NSCLC, gastric, head and neck, ovarian and synovial sarcoma. In December 2021, we reported initial Phase 1 data from this trial at the European Society of Medical Oncology Immuno-Oncology Congress (ESMO-IO) 2021. Preliminary data from the trial showed that IMC-C103C promising clinical activity with confirmed durable responses in ovarian cancer and a confirmed durable response in head and neck squamous cell carcinoma, or HNSCC and demonstrated a manageable safety profile. We have initiated an expansion arm cohort of the ongoing trial for patients with high-grade serous ovarian carcinoma and plan to observe dosing at a level of 140 micrograms/week. We anticipate reporting additional data from the Phase 1 portion of the trial in the fourth quarter of 2022. |

• | IMC-F106C, our ImmTAC molecule targeting an optimal HLA-A*02:01 PRAME antigen is currently being evaluated in a first-in-human, Phase ½ dose escalation trial in patients with multiple solid tumor cancers including NSCLC, SCLC, endometrial, ovarian, cutaneous melanoma, and breast cancers. As of December 31, 2021, we enrolled 39 patients in the Phase 1 clinical trial. Early pharmacodynamic data indicates that IMC-F106C monotherapy is demonstrating biological activity at the dose levels currently under evaluation. We anticipate reporting Phase 1 initial data from the trial in the third quarter of 2022. |

• | IMC-I109V, our ImmTAV molecule targeting a conserved hepatitis B virus, or HBV, envelope antigen, is our most advanced ImmTAV program and is currently being evaluated in a Phase ½ clinical trial in |

• | IMC-M113V, our ImmTAV molecule targeting the human immunosuppression virus, or HIV, gag antigen bispecific TCR molecule, is currently in pre-clinical development. Our goal is to develop a functional cure for HIV. Our clinical trial application in the United Kingdom was accepted in December 2021, and we anticipate dosing the first patient in this trial during the second quarter of 2022. We plan to then expand the trial to Europe later in 2022. |

• | an exemption from compliance with any requirement that the Public Company Accounting Oversight Board may adopt regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements; |

• | reduced disclosure about our executive compensation arrangements; |

• | an exemption from the non-binding advisory votes on executive compensation, including golden parachute arrangements; and |

• | an exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002. |

• | the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations with respect to a security registered under the Exchange Act; |

• | the requirement to comply with Regulation Fair Disclosure, or Regulation FD, which regulates selective disclosure of material information; |

• | the sections of the Exchange Act requiring insiders to file public reports of their share ownership and trading activities and liability for insiders who profit from trades made in a short period of time; and |

• | the rules under the Exchange Act requiring the filing with the SEC of quarterly reports on Form 10-Q containing unaudited financial and other specified information, or current reports on Form 8-K upon the occurrence of specified significant events. |

• | designation or classification; |

• | aggregate principal amount or aggregate offering price; |

• | maturity, if applicable; |

• | rates and times of payment of interest or dividends, if any; |

• | redemption, conversion or sinking fund terms, if any; |

• | voting or other rights, if any; and |

• | conversion or exercise prices, if any. |

• | the names of those agents or underwriters; |

• | applicable fees, discounts and commissions to be paid to them; |

• | details regarding over-allotment options, if any; and |

• | the net proceeds to us. |

• | our ability to maintain regulatory approval of KIMMTRAK (tebentafusp-tebn) for mUM in the United States; |

• | the timing of, and our ability to obtain and maintain regulatory approval of, KIMMTRAK in the European Union and respective European countries; |

• | our expectations regarding the potential commercialization of, the marketing and therapeutic potential of KIMMTRAK for mUM; |

• | our ability to build a sustainable pipeline of new medicine candidates, including but not limited to future generations of KIMMTRAK; |

• | the expected clinical benefits of KIMMTRAK including extended overall survival benefit; |

• | expectations regarding the timing of the commercial launch of KIMMTRAK, the timing of commercial availability and the ability to reach patients in a timely manner; |

• | the value proposition of KIMMTRAK in mUM and benefit as an orphan indication including expectations regarding the potential market size opportunity; |

• | our ability to successfully execute our sales and marketing strategy of KIMMTRAK in the United States, Europe and elsewhere, including continuing to successfully recruit and retain sales and marketing personnel and to successfully build the market for our medicines; |

• | our expectations about the willingness of healthcare providers to recommend KIMMTRAK to people with mUM; |

• | the rate and degree of market acceptance of our product candidates among physicians, patients, patient advocacy groups, third-party payors and the medical community and our ability and our distribution and marketing partners’ ability to obtain coverage and adequate reimbursement and pricing for, our medicines from government and third-party payers and risks relating to the success of our patient assistance programs; |

• | the market opportunities for our product candidates may be smaller than we estimate and any approval that we obtain may be based on a narrower definition of the patient population; |

• | the initiation, timing, progress and results of our current and future preclinical studies and clinical trials and related preparatory work and the period during which the results of the trials will become available, as well as our research and development programs; |

• | our estimates regarding expenses, future revenue, capital requirements and needs for additional financing; |

• | our expectations regarding timing of regulatory filings for, or our ability to obtain regulatory approval of, tebentafusp in additional jurisdictions, or any of our other product candidates; |

• | our ability to obtain accelerated approval for current and future product candidates from the FDA, EMA and MHRA; |

• | our ability to identify and develop additional product candidates using our ImmTAX platform; |

• | business disruptions affecting the initiation, patient enrollment, clinical trial site monitoring, development and operation of our current and proposed clinical trials, as well as commercialization of our products, including KIMMTRAK, including a public health emergency, such as the ongoing coronavirus 2019, or COVID-19, pandemic; |

• | the potential benefits of our product candidates; |

• | our business strategies and goals; |

• | our plans to collaborate, or statements regarding our current collaborations; |

• | our ability to find future partners and collaborators; |

• | the performance of our third-party suppliers and manufacturers, |

• | our expectations regarding our ability to obtain, maintain and enforce intellectual property protection for our product candidates and our ability to operate our business without infringing, misappropriating or otherwise violating the intellectual property rights of others; |

• | the effects of competition with respect to KIMMTRAK or any of our other current or future product candidates, as well as innovations by current and future competitors in our industry; |

• | regulatory developments in the United States and other countries, including potential changes in healthcare laws and regulations; |

• | our financial performance and our ability to effectively manage our anticipated growth; |

• | our ability to identify, recruit and retain qualified employees; |

• | the loss of key commercial or management personnel; |

• | whether we are classified as a PFIC for current and future periods; |

• | our ability to raise additional capital; and |

• | our estimates regarding the period of time for which our current capital resources will be sufficient to fund our continued operations, future expenses, revenues and needs for additional financing and the accuracy thereof. |

| | | As of December 31, 2021 | ||||

| | | (in thousands) | ||||

Cash and cash equivalents | | | £237,886 | | | $321,147 |

Non-current interest-bearing loans and borrowings | | | 37,226 | | | 50,255 |

Shareholders’ equity: | | | | | ||

Voting ordinary shares, nominal value £0.002 per share, 43,031,223 shares issued and outstanding as of December 31, 2021 | | | 86 | | | 116 |

Non-voting ordinary shares, nominal value £0.002 per share, 831,627 shares issued and outstanding as of December 31, 2021 | | | 2 | | | 2 |

Deferred shares, nominal value £0.0001 per share, 5,793,501 shares as of December 31, 2021 | | | — | | | 1 |

Share premium | | | 212,238 | | | 286,521 |

Other reserves | | | 440,613 | | | 594,828 |

Accumulated deficit | | | (481,392) | | | (649,879) |

Total shareholders’ equity | | | 171,547 | | | 231,589 |

Total capitalization | | | £208,773 | | | $281,844 |

• | 9,198,460 ordinary shares issuable upon the exercise of options outstanding under our equity incentive plans as of December 31, 2021, with a weighted-average exercise price of $22.31 per share; and |

• | 1,523,231 ordinary shares reserved for future issuance under our 2021 EIP as of December 31, 2021. |

• | a fixed price or prices, which may be changed from time to time; |

• | market prices prevailing at the time of sale; |

• | prices related to the prevailing market prices; or |

• | negotiated prices. |

• | the purchase by an institution of the securities covered under that contract shall not at the time of delivery be prohibited under the laws of the jurisdiction to which that institution is subject; and |

• | if the securities are also being sold to underwriters acting as principals for their own account, the underwriters shall have purchased such securities not sold for delayed delivery. The underwriters and other persons acting as our agents will not have any responsibility in respect of the validity or performance of delayed delivery contracts. |

• | each holder of our ordinary shares is entitled to one vote per ordinary share on all matters to be voted on by shareholders generally; |

• | the holders of the ordinary shares shall be entitled to receive notice of, attend, speak and vote at our general meetings; and |

• | the holders of our ordinary shares are entitled to receive such dividends as are recommended by our directors and declared by our shareholders. |

• | the deferred shares shall not be entitled to any dividends or to any other right of participation in the income or profits of the Company; |

• | on the return of assets on a winding-up of the Company, the deferred shares shall confer on the holders thereof an entitlement to receive out of the assets of the Company available for distribution amongst the members (subject to the rights of any new class of shares with preferred rights) the amount paid up or credited as paid up on the deferred shares held by them respectively after (but only after) payment |

• | the deferred shares do not entitle the holder thereof to receive notice of, or to attend, speak or vote at any general meeting, or be part of the quorum thereof as the holders of the deferred shares; and |

• | the Company shall have irrevocable authority from each holder of deferred shares to either (i) appoint any person to execute on behalf of any holder of deferred shares a transfer of all or any of those shares and/or an agreement to transfer the same (without making any payment for them) to such person or persons as the Company may determine and to execute any other documents which such person may consider necessary or desirable to effect such transfer, in each case without obtaining the sanction of the holder(s) and without any payment being made in respect of such acquisition; and (ii) to purchase all or any of the deferred shares without obtaining the consent of the holders of those shares in consideration for an amount not exceeding £1.00 in respect of all the deferred shares then being purchased. |

• | a holder of non-voting ordinary shares shall, in relation to the non-voting ordinary shares held by him or her, have no right to receive notice of, or to attend or vote at, any general meeting of shareholders save in relation to a variation of class rights of the non-voting ordinary shares; |

• | the non-voting ordinary shares shall be re-designated as ordinary shares by our board of directors, or a duly authorized committee or representative thereof, upon receipt of a re-designation notice and otherwise subject to the terms and conditions set out therein. A holder of non-voting ordinary shares shall not be entitled to have any non-voting ordinary shares re-designated as ordinary shares where such re-designation would result in such holder thereof beneficially owning (for purposes of section 13(d) of the Exchange Act), when aggregated with “affiliates” and “group” members with whom such holder is required to aggregate beneficial ownership for purposes of section 13(d) of the Exchange Act, in excess of 9.99 per cent. of any class of securities of the Company registered under the Exchange Act (which percentage may be increased or decreased on a holder-by-holder basis subject to the provisions set out therein); and |

• | the non-voting ordinary shares shall be re-designated as ordinary shares automatically upon transfer of a non-voting ordinary share by its holder to any person that is not an “affiliate” or “group member” with whom such holder is required to aggregate beneficial ownership for purposes of section 13(d) of the Exchange Act. This automatic re-designation shall only be in respect of the non-voting ordinary shares that are subject to such transfer. |

• | the name of any person, without sufficient cause, is wrongly entered in or omitted from our register of members; or |

• | there is a default or unnecessary delay in entering on the register the fact of any person having ceased to be a member or on which we have a lien, provided that such refusal does not prevent dealings in the shares taking place on an open and proper basis. |

• | Demand Registration on Form F-1 - each holder is entitled to demand registration on Form F-1, provided that these demand registration rights may only be exercised by holders who hold, in the aggregate, not less than 30% of the aggregate number of shares held, immediately prior to the completion of our initial public offering, by all holders who are party to the agreement. These demand registration rights may not be exercised more than twice. |

• | Demand Registration on Form F-3 - each holder is entitled to demand registration on Form F-3, if we are eligible to register shares on Form F-3, provided that these demand registration rights may only be exercised by holders who hold, in the aggregate, not less than 20% of the aggregate number of shares held, immediately prior to the completion of our initial public offering, by all holders who are party to the agreement. These demand registration rights may not be exercised more than twice in any calendar year. |

• | Piggyback Registration - each holder is entitled to piggyback registration rights, subject, in the case of an underwritten offering, to customary reductions by the underwriter. |

• | Expenses - we will pay all registration expenses relating to the exercise of the registration rights above, including the reasonable fees and expenses of one legal counsel to the participating holders up to a maximum of $50,000 in the aggregate. |

• | any resolution put to the vote of a general meeting must be decided exclusively on a poll; on a poll, every shareholder who is present in person or by proxy or corporate representative shall have one vote for each share of which they are the holder. A shareholder entitled to more than one vote need not, if they vote, use all their votes or cast all the votes in the same way; and |

• | if two or more persons are joint holders of a share, then in voting on any question the vote of the senior who tenders a vote, whether in person or by proxy, shall be accepted to the exclusion of the votes of the other joint holders. For this purpose seniority shall be determined by the order in which the names of the holders stand in the share register. |

• | it is for a share which is fully paid up; |

• | it is for a share upon which we have no lien; |

• | it is only for one class of share; |

• | it is in favor of a single transferee or no more than four joint transferees; |

• | it is duly stamped or is duly certificated or otherwise shown to the satisfaction of the board to be exempt from stamp duty (if this is required); and |

• | it is delivered for registration to our registered office (or such other place as the board may determine), accompanied (except in the case of a transfer by a person to whom we are not required by law to issue a certificate and to whom a certificate has not been issued or in the case of a renunciation) by the certificate for the shares to which it relates and such other evidence as the board may reasonably require to prove the title of the transferor (or person renouncing) and the due execution of the transfer or renunciation by him or, if the transfer or renunciation is executed by some other person on his behalf, the authority of that person to do so. |

• | the quorum for such class meeting shall be two holders in person or by proxy representing not less than one-third in nominal value of the issued shares of the class (excluding any shares held in treasury); and |

• | if at any adjourned meeting of such holders a quorum is not present at the meeting, one holder of shares of the class present in person or by proxy at an adjourned meeting constitutes a quorum. |

• | the giving of any guarantee, security or indemnity in respect of money lent or obligations incurred by him or by any other person at the request of or for the benefit of our company or any of our subsidiary undertakings; |

• | the giving of any guarantee, security or indemnity in respect of a debt or obligation of our company or any of our subsidiary undertakings for which he himself has assumed responsibility in whole or in part under a guarantee or indemnity or by the giving of security; |

• | any proposal or contract relating to an offer of securities of or by our company or any of our subsidiary undertakings in which offer he is or may be entitled to participate as a holder of securities or in the underwriting or sub-underwriting of which he is to participate; |

• | any arrangement involving any other company if the director (together with any person connected with him) has an interest of any kind in that company (including an interest by holding any position in that company or by being a member of that company), unless he is to his knowledge (either directly or indirectly) the holder of or beneficially interested in one per cent or more of any class of the equity share capital of that company (calculated exclusive of any shares of that class in that company held as treasury shares) or of the voting rights available to members of that company; |

• | any arrangement for the benefit of employees of our company or any of our subsidiary undertakings which only gives him benefits which are also generally given to employees to whom the arrangement relates; |

• | any contract relating to insurance which our company is to buy or renew for the benefit of the directors or a group of people which includes directors; and |

• | a contract relating to a pension, superannuation or similar scheme or a retirement, death, disability benefits scheme or employees’ share scheme which gives the director benefits which are also generally given to the employees to whom the scheme relates. |

• | any person, together with persons acting in concert with him, acquires, whether by a series of transactions over a period of time or not, an interest in shares which (taken together with shares in which he is already interested, and in which persons acting in concert with him are interested) carry 30% or more of the voting rights of a company; or |

• | any person who, together with persons acting in concert with him, is interested in shares which in the aggregate carry not less than 30% of the voting rights of a company but does not hold shares carrying more than 50% of such voting rights and such person, or any person acting in concert with him, acquires an interest in any other shares which increases the percentage of shares carrying voting rights in which he is interested, |

• | in respect of the default shares, the relevant shareholder shall not be entitled to vote (either in person or by representative or proxy) at any general meeting or to exercise any other right conferred by a shareholding in relation to general meetings; and |

• | where the default shares represent at least 0.25% in nominal value of the issued shares of their class, (a) any dividend or other money payable in respect of the default shares shall be retained by us without liability to pay interest and/or (b) no transfers by the relevant shareholder of any default shares may be registered (unless the shareholder himself is not in default and the shareholder provides a certificate, in a form satisfactory to the directors, to the effect that after due and careful enquiry the shareholder is satisfied that none of the shares to be transferred are default shares). |

• | if, at the time that the distribution is made, the amount of its net assets (that is, the total excess of assets over liabilities) is not less than the total of its called up share capital and undistributable reserves; and |

• | if, and to the extent that, the distribution itself, at the time that it is made, does not reduce the amount of the net assets to less than that total. |

| | | ENGLAND & WALES | | | DELAWARE | |

Number of Directors | | | Under the Companies Act, a public limited company must have at least two directors and the number of directors may be fixed by or in the manner provided in a company’s articles of association. | | | Under Delaware law, a corporation must have at least one director and the number of directors shall be fixed by or in the manner provided in the bylaws. |

| | | | | |||

Removal of Directors | | | Under the Companies Act, shareholders may remove a director without cause by an ordinary resolution (which is passed by a simple majority of those voting in person or by proxy at a general meeting) irrespective of any provisions of any service contract the director has with the Company, provided 28 clear days’ notice of the resolution has been given to the Company and its shareholders. On receipt of notice of an intended resolution to remove a director, the Company must forthwith send a copy of the notice to the director concerned. Certain other procedural requirements under the. Companies Act must also be followed such as allowing the director to make representations against his or her removal either at the meeting or in writing. | | | Under Delaware law, any director or the entire board of directors may be removed, with or without cause, by the holders of a majority of the shares then entitled to vote at an election of directors, except (a) unless the certificate of incorporation provides otherwise, in the case of a corporation whose board of directors is classified, shareholders may effect such removal only for cause, or (b) in the case of a corporation having cumulative voting, if less than the entire board of directors is to be removed, no director may be removed without cause if the votes cast against his removal would be sufficient to elect him if then cumulatively voted at an election of the entire board of directors, or, if there are classes of directors, at an election of the class of directors of which he is a part. |

| | | | | |||

Vacancies on the Board of Directors | | | Under the laws of England and Wales, the procedure by which directors, other than a company’s initial directors, are appointed is generally set out in a company’s articles of association, provided that where two or more persons are appointed as directors of a public limited company by resolution of the shareholders, resolutions appointing each director must be voted on individually. | | | Under Delaware law, vacancies and newly created directorships may be filled by a majority of the directors then in office (even though less than a quorum) or by a sole remaining director unless (a) otherwise provided in the certificate of incorporation or by-laws of the corporation or (b) the certificate of incorporation directs that a particular class of stock is to elect such director, in which case a majority of the other directors elected by such class, or a sole remaining director elected. |

| | | | | |||

Annual General Meeting | | | Under the Companies Act, a public limited company must hold an annual general meeting in each six-month period following its annual accounting reference date. | | | Under Delaware law, the annual meeting of stockholders shall be held at such place, on such date and at such time as may be designated from time to time by the board of directors or as provided in the certificate of incorporation or by the bylaws. |

| | | ENGLAND & WALES | | | DELAWARE | |

General Meeting | | | Under the Companies Act, a general meeting of the shareholders of a public limited company may be called by the directors. | | | Under Delaware law, special meetings of the stockholders may be called by the board of directors or by such person or persons as may be authorized by the certificate of incorporation or by the bylaws. |

| | | | | |||

| | | Shareholders holding at least 5% of the paid-up capital of the Company carrying voting rights at general meetings (excluding any paid up capital held as treasury shares) can require the directors to call a general meeting and, if the directors fail to do so within a certain period, may themselves (or any of them representing more than one half of the total voting rights of all of them) convene a general meeting. | | | ||

| | | | | |||

Notice of General Meetings | | | Subject to a company’s articles of association providing for a longer period, under the Companies Act, 21 clear days’ notice must be given for an annual general meeting and any resolutions to be proposed at the meeting. Subject to a company’s articles of association providing for a longer period, at least 14 clear days’ notice is required for any other general meeting. In addition, certain matters, such as the removal of directors or auditors, require special notice, which is 28 clear days’ notice. The shareholders of a company may in all cases consent to a shorter notice period, the proportion of shareholders’ consent required being 100% of those entitled to attend and vote in the case of an annual general meeting and, in the case of any other general meeting, a majority in number of the members having a right to attend and vote at the meeting, being a majority who together hold not less than 95% in nominal value of the shares giving a right to attend and vote at the meeting. | | | Under Delaware law, unless otherwise provided in the certificate of incorporation or bylaws, written notice of any meeting of the stockholders must be given to each stockholder entitled to vote at the meeting not less than 10 nor more than 60 days before the date of the meeting and shall specify the place, date, hour, and purpose or purposes of the meeting. |

| | | | | |||

Quorum | | | Subject to the provisions of a company’s articles of association, the Companies Act provides that two shareholders present at a meeting (in person, by proxy or authorized representative under the Companies Act) shall constitute a quorum for companies with more than one member. | | | The certificate of incorporation or bylaws may specify the number of shares, the holders of which shall be present or represented by proxy at any meeting in order to constitute a quorum, but in no event shall a quorum consist of less than one third of the shares entitled to vote at the meeting. In the absence of suchspecification in the certificate of |

| | | ENGLAND & WALES | | | DELAWARE | |

| | | | | incorporation or bylaws, a majority of the shares entitled to vote, present in person or represented by proxy, shall constitute a quorum at a meeting of stockholders. | ||

| | | | | |||

Proxy | | | Under the Companies Act, at any meeting of shareholders, a shareholder may designate another person to attend, speak and vote at the meeting on their behalf by proxy. | | | Under Delaware law, at any meeting of stockholders, a stockholder may designate another person to act for such stockholder by proxy, but no such proxy shall be voted or acted upon after three years from its date, unless the proxy provides for a longer period. A director of a Delaware corporation may not issue a proxy representing the director’s voting rights as a director. |

| | | | | |||

Preemptive Rights | | | Under the Companies Act, “equity securities,” being (1) shares in the Company other than shares that, with respect to dividends and capital, carry a right to participate only up to a specified amount in a distribution, referred to as “ordinary shares,” or (2) rights to subscribe for, or to convert securities into, ordinary shares, proposed to be allotted for cash must be offered first to the existing equity shareholders in the Company in proportion to the respective nominal value of their holdings, unless an exception applies or a special resolution to the contrary has been passed by shareholders in a general meeting or the articles of association provide otherwise in each case in accordance with the provisions of the Companies Act. | | | Under Delaware law, shareholders have no preemptive rights to subscribe to additional issues of stock or to any security convertible into such stock unless, and except to the extent that, such rights are expressly provided for in the certificate of incorporation. |

| | | | | |||

Authority to Allot | | | Under the Companies Act, the directors of a company must not allot shares or grant of rights to subscribe for or to convert any security into shares unless an exception applies or an ordinary resolution to the contrary has been passed by shareholders in a general meeting or the articles of association provide otherwise in each case in accordance with the provisions of the Companies Act. | | | Under Delaware law, if the corporation’s charter or certificate of incorporation so provides, the board of directors has the power to authorize the issuance of stock. It may authorize capital stock to be issued for consideration consisting of cash, any tangible or intangible property or any benefit to the corporation or any combination thereof. It may determine the amount of such consideration by approving a formula. In the absence of actual fraud in the transaction, the judgment of the directors as to the value of such consideration is conclusive. |

| | | ENGLAND & WALES | | | DELAWARE | |

Liability of Directors and Officers | | | Under the Companies Act, any provision, whether contained in a company’s articles of association or any contract or otherwise, that purports to exempt a director of a company, to any extent, from any liability that would otherwise attach to him in connection with any negligence, default, breach of duty or breach of trust in relation to the Company is void. Any provision by which a company directly or indirectly provides an indemnity, to any extent, for a director of the Company or of an associated company against any liability attaching to him in connection with any negligence, default, breach of duty or breach of trust in relation to the Company of which he is a director is also void except as permitted by the Companies Act, which provides exceptions for the Company to (a) purchase and maintain insurance against such liability; (b) provide a “qualifying third party indemnity” (being an indemnity against liability incurred by the director to a person other than the Company or an associated company or criminal proceedings in which he is convicted); and (c) provide a “qualifying pension scheme indemnity” (being an indemnity against liability incurred in connection with our activities as trustee of an occupational pension plan). | | | Under Delaware law, a corporation’s certificate of incorporation may include a provision eliminating or limiting the personal liability of a director to the corporation and its stockholders for damages arising from a breach of fiduciary duty as a director. However, no provision can limit the liability of a director for: • any breach of the director’s duty of loyalty to the corporation or its stockholders • acts or omissions not in good faith or that involve intentional misconduct or a knowing violation of law; • intentional or negligent payment of unlawful dividends or stock purchases or redemptions; or • any transaction from which the director derives an improper personal benefit. |

| | | | | |||

Voting Rights | | | For a company incorporated under the laws of England and Wales, it is usual for the articles of association to provide that, unless a poll is demanded by the shareholders of a company or is required by the chairman of the meeting or our articles of association, shareholders shall vote on all resolutions on a show of hands. Under the Companies Act, a poll may be demanded by (a) not fewer than five shareholders having the right to vote on the resolution; (b) any shareholder(s) representing not less than 10% of the total voting rights of all the shareholders having the right to vote on the resolution (excluding any voting rights attaching to treasury shares); or (c) any shareholder(s) holding shares in the Company conferring a right to vote on the resolution | | | Delaware law provides that, unless otherwise provided in the certificate of incorporation, each stockholder is entitled to one vote for each share of capital stock held by such stockholder. |

| | | ENGLAND & WALES | | | DELAWARE | |

| | | (excluding any voting rights attaching to treasury shares) being shares on which an aggregate sum has been paid up equal to not less than 10% of the total sum paid up on all the shares conferring that right. A company’s articles of association may provide more extensive rights for shareholders to call a poll. | | | ||

| | | | | |||

| | | Under the laws of England and Wales, an ordinary resolution is passed on a show of hands if it is approved by a simple majority (more than 50%) of the votes cast by shareholders present (in person or by proxy) and entitled to vote. If a poll is demanded, an ordinary resolution is passed if it is approved by holders representing a simple majority of the total voting rights of shareholders present, in person or by proxy, who, being entitled to vote, vote on the resolution. Special resolutions require the affirmative vote of not less than 75% of the votes cast by shareholders present, in person or by proxy, at the meeting. If a poll is demanded, a special resolution is passed if it is approved by holders representing not less than 75% of the total voting rights of shareholders in person or by proxy who, being entitled to vote, vote on the resolution. | | | ||

| | | | | |||

Shareholder Vote on Certain Transactions | | | The Companies Act provides for schemes of arrangement, which are arrangements or compromises between a company and any class of shareholders or creditors and used in certain types of reconstructions, amalgamations, capital reorganizations, or takeovers. These arrangements require: • the approval at a shareholders’ or creditors’ meeting convened by order of the court, of a majority in number of shareholders or creditors or a class thereof representing 75% in value of the capital held by, or debt owed to, the class of shareholders or creditors, or class thereof present and voting, either in person or by proxy; and • the approval of the court. | | | Generally, under Delaware law, unless the certificate of incorporation provides for the vote of a larger portion of the stock, completion of a merger, consolidation, sale, lease or exchange of all or substantially all of a corporation’s assets or dissolution requires: • the approval of the board of directors; and • the approval by the vote of the holders of a majority of the outstanding stock or, if the certificate of incorporation provides for more or less than one vote per share, a majority of the votes of the outstanding stock of the corporation entitled to vote on the matter. |

| | | | |

| | | ENGLAND & WALES | | | DELAWARE | |

Standard of Conduct for Directors | | | Under the laws of England and Wales, a director owes various statutory and fiduciary duties to the company, including: • to act in the way he considers, in good faith, would be most likely to promote the success of the Company for the benefit of its members as a whole, and in doing so have regard (amongst other matters) to: (i) the likely consequences of any decision in the long-term, (ii) the interests of the company’s employees, (iii) the need to foster the company’s business relationships with suppliers, customers and others, (iv) the impact of the company’s operations on the community and the environment, (v) the desirability to maintain a reputation for high standards of business conduct, and (vi) the need to act fairly as between members of the company; • to avoid a situation in which he has, or can have, a direct or indirect interest that conflicts, or possibly conflicts, with the interests of the Company; • to act in accordance with our constitution and only exercise his powers for the purposes for which they are conferred; • to exercise independent judgment; • to exercise reasonable care, skill and diligence; • not to accept benefits from a third party conferred by reason of his being a director or doing, or not doing, anything as a director; and • to declare any interest that he has, whether directly or indirectly, in a proposed or existing transaction or arrangement with the company. | | | Delaware law does not contain specific provisions setting forth the standard of conduct of a director. The scope of the fiduciary duties of directors is generally determined by the courts of the State of Delaware. In general, directors have a duty to act without self-interest, on a well-informed basis and in a manner they reasonably believe to be in the best interest of the stockholders. Directors of a Delaware corporation owe fiduciary duties of care and loyalty to the corporation and to its shareholders. The duty of care generally requires that a director act in good faith, with the care that an ordinarily prudent person would exercise under similar circumstances. Under this duty, a director must inform himself of all material information reasonably available regarding a significant transaction. The duty of loyalty requires that a director act in a manner he reasonably believes to be in the best interests of the corporation. He must not use his corporate position for personal gain or advantage. In general, but subject to certain exceptions, actions of a director are presumed to have been made on an informed basis, in good faith and in the honest belief that the action taken was in the best interests of the corporation. However, this presumption may be rebutted by evidence of a breach of one of the fiduciary duties. Delaware courts have also imposed a heightened standard of conduct upon directors of a Delaware corporation who take any action designed to defeat a threatened change in control of the corporation. In addition, under Delaware law, when the board of directors of a Delaware corporation approves the sale or break-up of a corporation, the board of directors may, in certain circumstances, have a duty to obtain the highest value reasonably available to the shareholders. |

| | | | |

| | | ENGLAND & WALES | | | DELAWARE | |

Shareholder Litigation | | | Under the laws of England and Wales, generally, the Company, rather than its shareholders, is the proper claimant in an action in respect of a wrong done to the Company or where there is an irregularity in the Company’s internal management. Notwithstanding this general position, the Companies Act provides that (1) a court may allow a shareholder to bring a derivative claim (that is, an action in respect of and on behalf of the Company) in respect of a cause of action arising from a director’s negligence, default, breach of duty or breach of trust and (2) a shareholder may bring a claim for a court order where our affairs have been or are being conducted in a manner that is unfairly prejudicial to some of its shareholders. | | | Under Delaware law, a stockholder may initiate a derivative action to enforce a right of a corporation if the corporation fails to enforce the right itself. The complaint must: • state that the plaintiff was a stockholder at the time of the transaction of which the plaintiff complains or that the plaintiff’s shares thereafter devolved on the plaintiff by operation of law; and • allege with particularity the efforts made by the plaintiff to obtain the action the plaintiff desires from the directors and the reasons for the plaintiff’s failure to obtain the action; or • state the reasons for not making the effort. Additionally, the plaintiff must remain a stockholder through the duration of the derivative suit. The action will not be dismissed or compromised without the approval of the Delaware Court of Chancery. |

• | we do not timely request that the rights be distributed to you or we request that the rights not be distributed to you; or |

• | we fail to deliver satisfactory documents to the depositary; or |

• | it is not reasonably practicable to distribute the rights. |

• | we do not request that the property be distributed to you or if we ask that the property not be distributed to you; or |

• | we do not deliver satisfactory documents to the depositary; or |

• | the depositary determines that all or a portion of the distribution to you is not reasonably practicable. |

• | the ordinary shares are duly authorized, validly allotted and issued, fully paid, not subject to any call for the payment of further capital and legally obtained; |

• | all preemptive (and similar) rights, if any, with respect to such ordinary shares have been validly waived, disapplied or exercised; |

• | you are duly authorized to deposit the ordinary shares; |

• | the ordinary shares presented for deposit are free and clear of any lien, encumbrance, security interest, charge, mortgage or adverse claim, and are not, and the ADSs issuable upon such deposit will not be, “restricted securities” (as defined in the deposit agreement); and |

• | the ordinary shares presented for deposit have not been stripped of any rights or entitlements. |

• | ensure that the surrendered ADR is properly endorsed or otherwise in proper form for transfer; |

• | provide such proof of identity and genuineness of signatures, and of such other matters contemplated in the deposit agreement, as the depositary deems appropriate; |

• | comply with applicable laws and regulations, including regulations imposed by us and the depositary consistent with the deposit agreement, the ADR and applicable law; |

• | provide any transfer stamps required by the State of New York or the United States; and |

• | pay all applicable fees, charges, expenses, taxes and other government charges payable by ADR holders pursuant to the terms of the deposit agreement, upon the transfer of ADRs. |

• | temporary delays that may arise because (1) the transfer books for the ordinary shares or ADSs are closed, or (2) ordinary shares are immobilized on account of a shareholders’ meeting or a payment of dividends; |

• | obligations to pay fees, taxes and similar charges; or |

• | restrictions imposed because of laws or regulations applicable to ADSs or the withdrawal of securities on deposit. |

• | In the event of voting by show of hands, the depositary will vote (or cause the custodian to vote) all ordinary shares held on deposit at that time in accordance with the voting instructions received from a majority of holders of ADSs who provide timely voting instructions. |

• | In the event of voting by poll, the depositary will vote (or cause the custodian to vote) the ordinary shares held on deposit in accordance with the voting instructions received from the holders of ADSs. |

SERVICE | | | FEE |

Issuance of ADSs (e.g., an issuance of ADS upon a deposit of ordinary shares or upon a change in the ADS(s)-to-ordinary shares ratio, or for any other reason), excluding ADS issuances as a result of distributions of ordinary shares | | | Up to $0.05 per ADS issued |

| | |

SERVICE | | | FEE |

Cancellation of ADSs (e.g., a cancellation of ADSs for delivery of deposited property or upon a change in the ADS(s)-to-ordinary shares ratio, or for any other reason) | | | Up to $0.05 per ADS cancelled |

| | | ||

Distribution of cash dividends or other cash distributions (e.g., upon a sale of rights and other entitlements) | | | Up to $0.05 per ADS held |

| | | ||

Distribution of ADSs pursuant to (i) share dividends or other distributions, or (ii) exercise of rights to purchase additional ADSs | | | Up to $0.05 per ADS held |

| | | ||

Distribution of securities other than ADSs or rights to purchase additional ADSs (e.g., upon a spin-off) | | | Up to $0.05 per ADS held |

| | | ||

ADS services | | | Up to $0.05 per ADS held on the applicable record date(s) established by the depositary |

| | | ||

Registration of ADS transfers (e.g., upon a registration of the transfer of registered ownership of ADSs, upon a transfer of ADSs into DTC and vice versa, or for any other reason). | | | Up to $0.05 per ADS transferred |

| | | ||

Conversion of ADSs of one series for ADSs of another series (e.g., upon conversion of Partial Entitlement ADSs for Full Entitlement ADSs, or upon conversion of Restricted ADSs into freely transferrable ADSs, and vice versa) | | | Up to $0.05 per ADS converted |

• | taxes (including applicable interest and penalties) and other governmental charges; |

• | the registration fees as may from time to time be in effect for the registration of ordinary shares on the share register and applicable to transfers of ordinary shares to or from the name of the custodian, the depositary or any nominees upon the making of deposits and withdrawals, respectively; |

• | certain cable, telex and facsimile transmission and delivery expenses; |

• | the expenses and charges incurred by the depositary in the conversion of foreign currency; |

• | the fees and expenses incurred by the depositary in connection with compliance with exchange control regulations and other regulatory requirements applicable to ordinary shares, ADSs and ADRs; |

• | any reasonable and customary out-of-pocket expenses incurred in such conversion and/or on behalf of the ADS holders and beneficial owners in complying with currency exchange control or other governmental requirements; and |

• | the fees and expenses incurred by the depositary, the custodian or any nominee in connection with the servicing or delivery of deposited property. |

• | We and the depositary are obligated only to take the actions specifically stated in the deposit agreement without negligence or bad faith. |

• | The depositary disclaims any liability for any failure to carry out voting instructions, for any manner in which a vote is cast or for the effect of any vote, provided it acts in good faith and in accordance with the terms of the deposit agreement. |

• | The depositary disclaims any liability for any failure to accurately determine the lawfulness or practicality of any action, for the content of any document forwarded to you on our behalf or for the accuracy of any translation of such a document, for the investment risks associated with investing in ordinary shares, for the validity or worth of the ordinary shares, for any tax consequences that result from the ownership of ADSs or other deposited property, for the credit-worthiness of any third party, for allowing any rights to lapse under the terms of the deposit agreement, for the timeliness of any of our notices or for our failure to give notice or for any act or omission of or information provided by DTC or any DTC participant. |

• | The depositary shall not be liable for acts or omissions of any successor depositary in connection with any matter arising wholly after the resignation or removal of the depositary. |

• | We and the depositary will not be obligated to perform any act that is inconsistent with the terms of the deposit agreement. |

• | We and the depositary disclaim any liability if we or the depositary are prevented or forbidden from or subject to any civil or criminal penalty or restraint on account of, or delayed in, doing or performing any act or thing required by the terms of the deposit agreement, by reason of any provision, present or future of any law or regulation, including regulations of any stock exchange or by reason of present or future provisions of our articles of association, or any provision of or governing the securities on deposit, or by reason of any act of God or war or other circumstances beyond our or the depositary’s control. |

• | We and the depositary disclaim any liability by reason of any exercise of, or failure to exercise, any discretion provided for in the deposit agreement or in our articles of association or in any provisions of or governing the securities on deposit. |

• | We and the depositary further disclaim any liability for any action or inaction in reliance on the advice or information received from legal counsel, accountants, any person presenting ordinary shares for deposit, any holder of ADSs or authorized representatives thereof, or any other person believed by either of us in good faith to be competent to give such advice or information. |

• | We and the depositary also disclaim liability for the inability by any ADS holder or beneficiary owner to benefit from any distribution, offering, right or other benefit that is made available to holders of ordinary shares but is not, under the terms of the deposit agreement, made available to you. |

• | We and the depositary may rely without any liability upon any written notice, request or other document believed to be genuine and to have been signed or presented by the proper parties. |

• | We and the depositary also disclaim liability for any consequential or punitive damages for any breach of the terms of the deposit agreement. |

• | We and the depositary disclaim liability arising out of losses, liabilities, taxes, charges or expenses resulting from the manner in which a holder or beneficial owner of ADSs holds ADSs, including resulting from holding ADSs through a brokerage account. |

• | No disclaimer of any Securities Act liability is intended by any provision of the deposit agreement. |

• | Nothing in the deposit agreement gives rise to a partnership or joint venture, or establishes a fiduciary relationship, among us, the depositary and you as ADS holder. |

• | Nothing in the deposit agreement precludes Citibank (or its affiliates) from engaging in transactions in which parties adverse to us or the ADS owners have interests, and nothing in the deposit agreement obligates Citibank to disclose those transactions, or any information obtained in the course of those transactions, to us or to the ADS owners, or to account for any payment received as part of those transactions. |

• | Convert the foreign currency to the extent practical and lawful and distribute the U.S. dollars to the ADS holders for whom the conversion and distribution is lawful and practical. |

• | Distribute the foreign currency to ADS holders for whom the distribution is lawful and practical. |

• | Hold the foreign currency (without liability for interest) for the applicable ADS holders. |

• | title or designation; |

• | the aggregate principal amount and any limit on the amount that may be issued; |

• | the currency or units based on or relating to currencies in which debt securities of such series are denominated and the currency or units in which principal or interest or both will or may be payable; |

• | whether we will issue the series of debt securities in global form, the terms of any global securities and who the depositary will be; |

• | the maturity date and the date or dates on which principal will be payable; |

• | the interest rate, which may be fixed or variable, or the method for determining the rate and the date interest will begin to accrue, the date or dates interest will be payable and the record dates for interest payment dates or the method for determining such dates; |

• | whether or not the debt securities will be secured or unsecured, and the terms of any secured debt; |

• | the terms of the subordination of any series of subordinated debt; |

• | the place or places where payments will be payable; |

• | our right, if any, to defer payment of interest and the maximum length of any such deferral period; |

• | the date, if any, after which, and the price at which, we may, at our option, redeem the series of debt securities pursuant to any optional redemption provisions; |

• | the date, if any, on which, and the price at which we are obligated, pursuant to any mandatory sinking fund provisions or otherwise, to redeem, or at the holder’s option to purchase, the series of debt securities; |

• | whether the indenture will restrict our ability to pay dividends, or will require us to maintain any asset ratios or reserves; |

• | whether we will be restricted from incurring any additional indebtedness; |

• | a discussion of any material or special U.S. federal income tax considerations applicable to a series of debt securities; |

• | the denominations in which we will issue the series of debt securities, if other than denominations of $1,000 and any integral multiple thereof; and |

• | any other specific terms, preferences, rights or limitations of, or restrictions on, the debt securities. We may issue debt securities that provide for an amount less than their stated principal amount to be due and payable upon declaration of acceleration of their maturity pursuant to the terms of the indenture. We will provide you with information on the federal income tax considerations and other special considerations applicable to any of these debt securities in the applicable prospectus supplement. |

• | if we fail to pay interest when due and our failure continues for 90 days and the time for payment has not been extended or deferred; |

• | if we fail to pay the principal, or premium, if any, when due and the time for payment has not been extended or delayed; |

• | if we fail to observe or perform any other covenant set forth in the debt securities of such series or the applicable indentures, other than a covenant specifically relating to and for the benefit of holders of another series of debt securities, and our failure continues for 90 days after we receive written notice from the debenture trustee or holders of not less than a majority in aggregate principal amount of the outstanding debt securities of the applicable series; and |

• | if specified events of bankruptcy, insolvency or reorganization occur as to us. |

• | the direction so given by the holder is not in conflict with any law or the applicable indenture; and |

• | subject to its duties under the Trust Indenture Act, the debenture trustee need not take any action that might involve it in personal liability or might be unduly prejudicial to the holders not involved in the proceeding. |

• | these limitations do not apply to a suit instituted by a holder of debt securities if we default in the payment of the principal, premium, if any, or interest on, the debt securities; |

• | the holder previously has given written notice to the debenture trustee of a continuing event of default with respect to that series; |

• | the holders of at least a majority in aggregate principal amount of the outstanding debt securities of that series have made written request to institute the proceeding, and such holders have offered indemnity satisfactory to the debenture trustee to institute the proceeding as trustee; and |

• | the debenture trustee does not institute the proceeding, and does not receive from the holders of a majority in aggregate principal amount of the outstanding debt securities of that series (or at a meeting of holders of such series at which a quorum is present, the holders of a majority in principal amount of the debt securities of such series represented at such meeting) other conflicting directions within 60 days after the notice, request and offer. |

• | to fix any ambiguity, defect or inconsistency in the indenture or in the debt securities; and |

• | to change anything that does not materially adversely affect the rights of any holder of debt securities of any series issued pursuant to such indenture. |

• | extending the fixed maturity of the series of debt securities; |

• | reducing the principal amount, reducing the rate of or extending the time of payment of interest, or any premium payable upon the redemption of any debt securities; or |

• | reducing the percentage of debt securities, the holders of which are required to consent to any amendment or waiver. |

• | the transfer or exchange of debt securities of the series; |

• | replace stolen, lost, destroyed or mutilated debt securities of the series; |

• | payment of principal, premium and interest; |

• | maintain an office or agency; |

• | maintain paying agents; |

• | hold monies for payment in trust; |

• | compensate and indemnify the trustee; and |

• | appoint any successor trustee. |

• | issue, register the transfer of, or exchange any debt securities of that series during a period beginning at the opening of business 15 days before the day of mailing of a notice of redemption of any debt securities that may be selected for redemption and ending at the close of business on the day of the mailing; or |

• | register the transfer of or exchange any debt securities so selected for redemption, in whole or in part, except the unredeemed portion of any debt securities we are redeeming in part. |

• | the specific designation and aggregate number of, and the price at which we will issue, the warrants; |

• | the currency or currency units in which the offering price, if any, and the exercise price are payable; |

• | the designation, amount and terms of the securities purchasable upon exercise of the warrants; |

• | if applicable, the exercise price for our ADSs and the number of ADSs to be received upon exercise; |

• | if applicable, the exercise price for our debt securities, the amount of debt securities to be received upon exercise, and a description of that series of debt securities; |

• | the date on which the right to exercise the warrants will begin and the date on which that right will expire or, if you may not continuously exercise the warrants throughout that period, the specific date or dates on which you may exercise the warrants; |

• | whether the warrants will be issued in fully registered form or bearer form, in definitive or global form or in any combination of these forms; |