addition to the specific candidate sequence. Granted patents have been obtained in major territories including two in the United States and 28 in foreign jurisdictions, including Europe (including United Kingdom, France, Germany, Italy, Spain, Ireland, Denmark and the Netherlands), Australia, Canada, China, Hong Kong, Japan, Mexico, Eurasia and South Africa. These granted patents are expected to expire in 2030, subject to further patent term adjustments, patent term extensions and/or supplementary protection certificates. Further protection may be achieved if further pending patent applications covering the expected label dosing regimen and formulation of tebentafusp are granted. The dosing regimen patent applications include one pending in the United States and nine pending in foreign jurisdictions, including Europe, Australia, Brazil, Canada, China, Japan, Mexico, Russia and South Africa. The formulation patent family currently includes one pending PCT patent application. If granted the dosing regimen patent application family would expire in 2037 and any U.S. non-provisional or foreign patent applications timely filed based on the formulation PCT application family would expire in 2040, each excluding any additional term for patent term adjustments or patent term extensions.

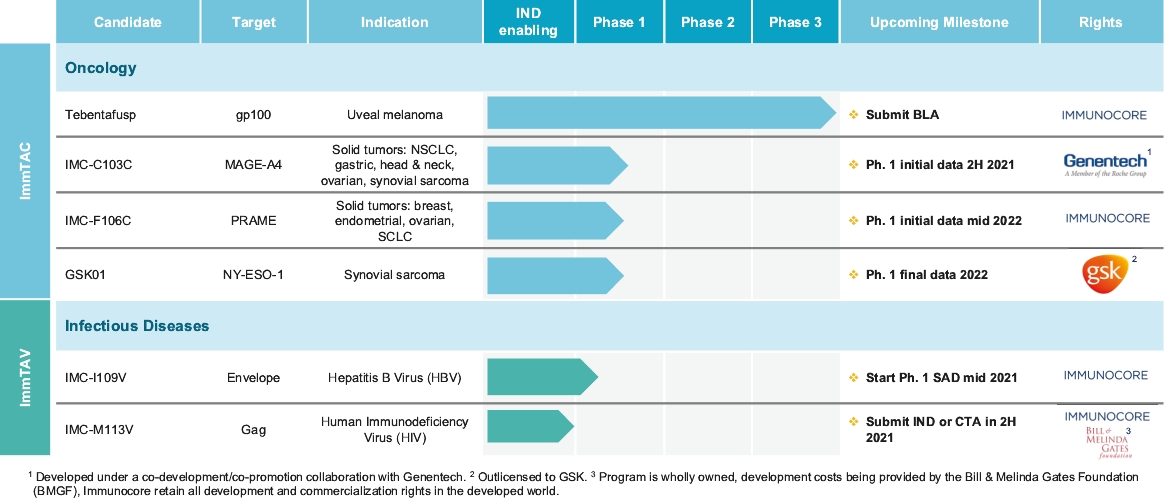

Further soluble TCR bispecific candidates

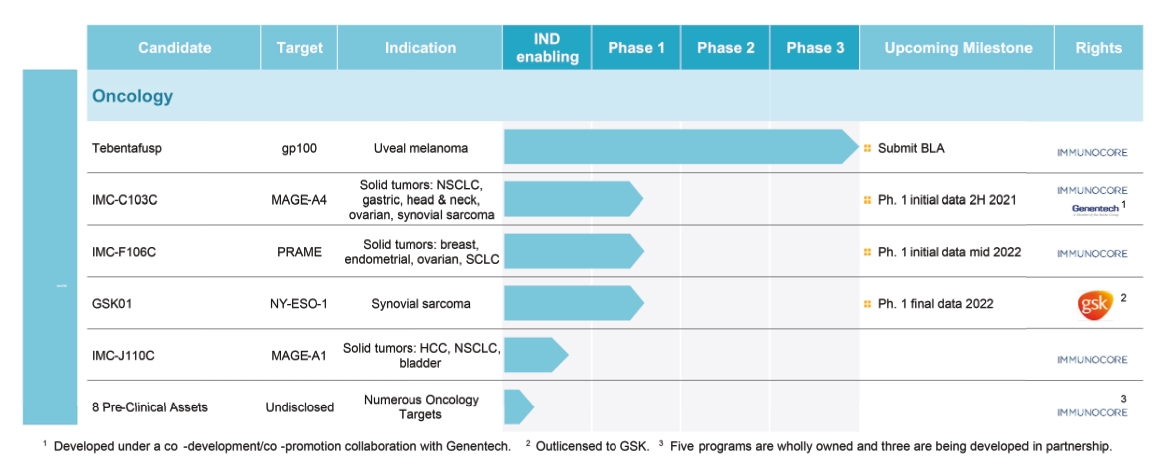

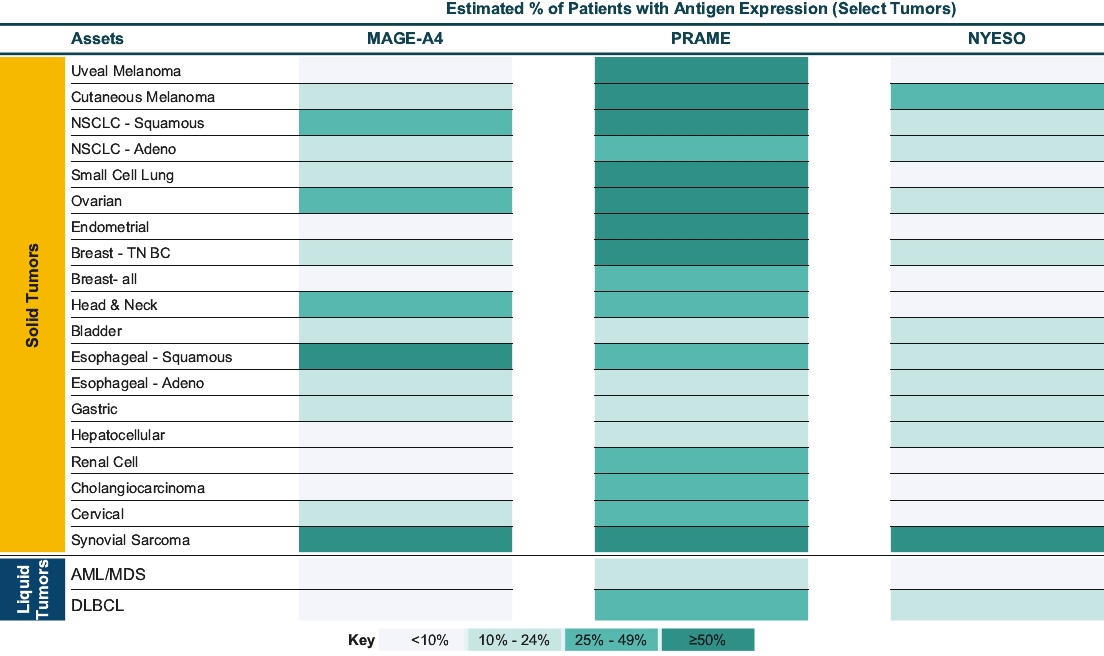

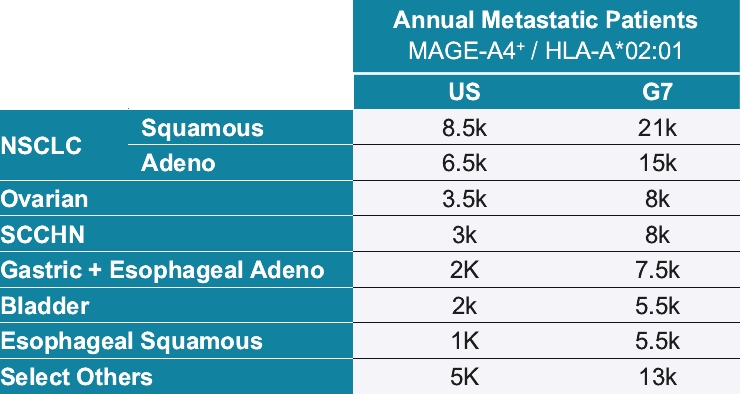

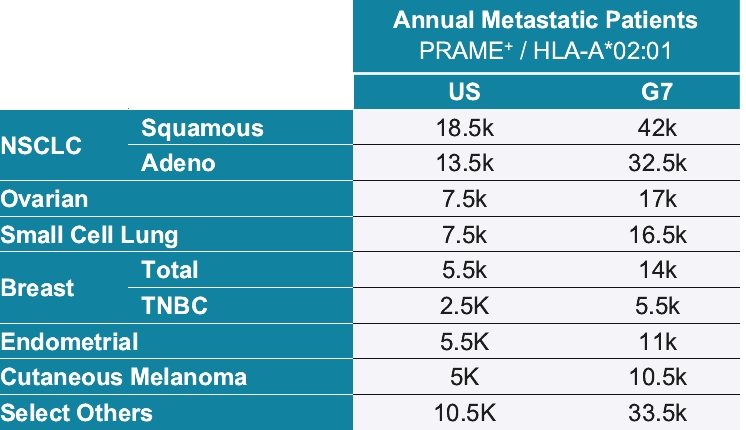

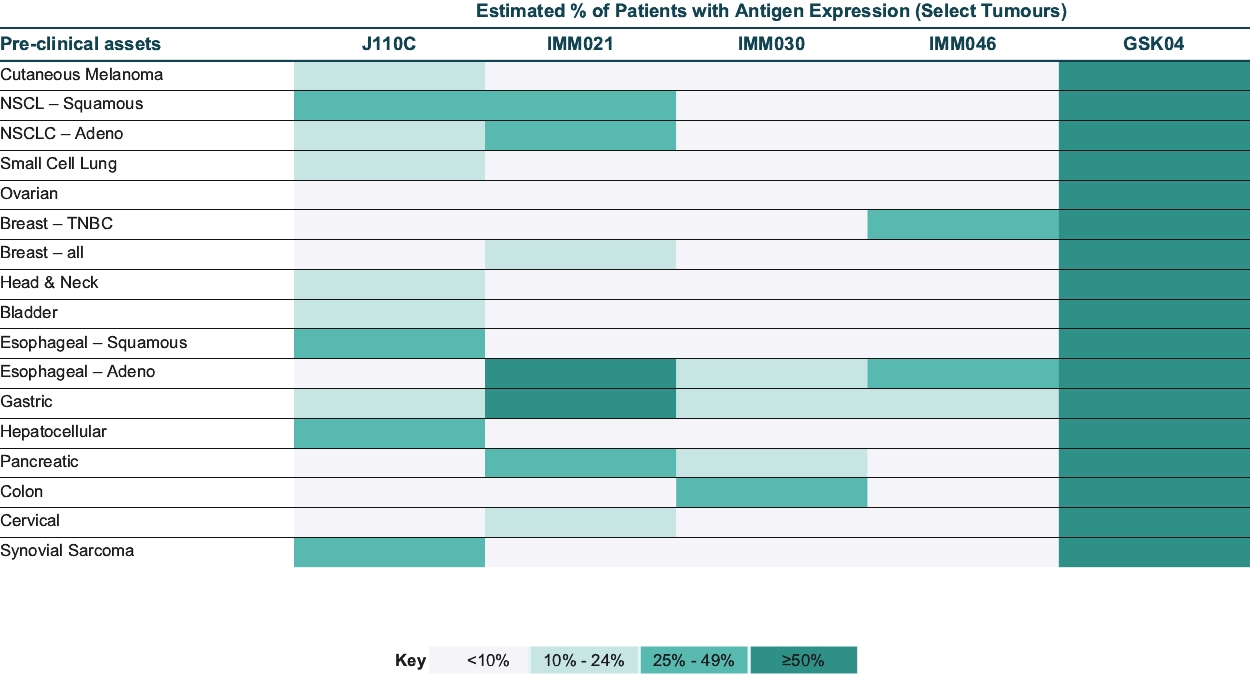

As of October 31, 2020, we own pending composition of matter patent applications, including three pending U.S. patent applications and 52 pending foreign patent applications and one PCT application, covering further clinical and pre-clinical stage soluble TCR bispecific therapeutic candidates for oncology, including IMC-C103C, IMC-F106C, GSK01 and IMC-J110C targeting NY-ESO, MAGE-A4, PRAME and MAGE-A1. In each case, claims of the patent application are directed to the engineered soluble TCR bispecific therapeutic candidate and to TCR variants with similar biological properties. If granted, patents derived from these applications or applications that claim priority from these applications would expire in 2036 for GSK01, 2037 for IMC-C103C, 2038 for IMC-F106C and 2041 for IMC-J110C, excluding any additional term for patent term adjustments or patent term extensions. National patent applications for GSK-01, IMC-C103C and IMC-F106C have been filed in the United States and foreign jurisdictions, including Europe, Australia, Canada, China, Japan, Mexico and Russia.

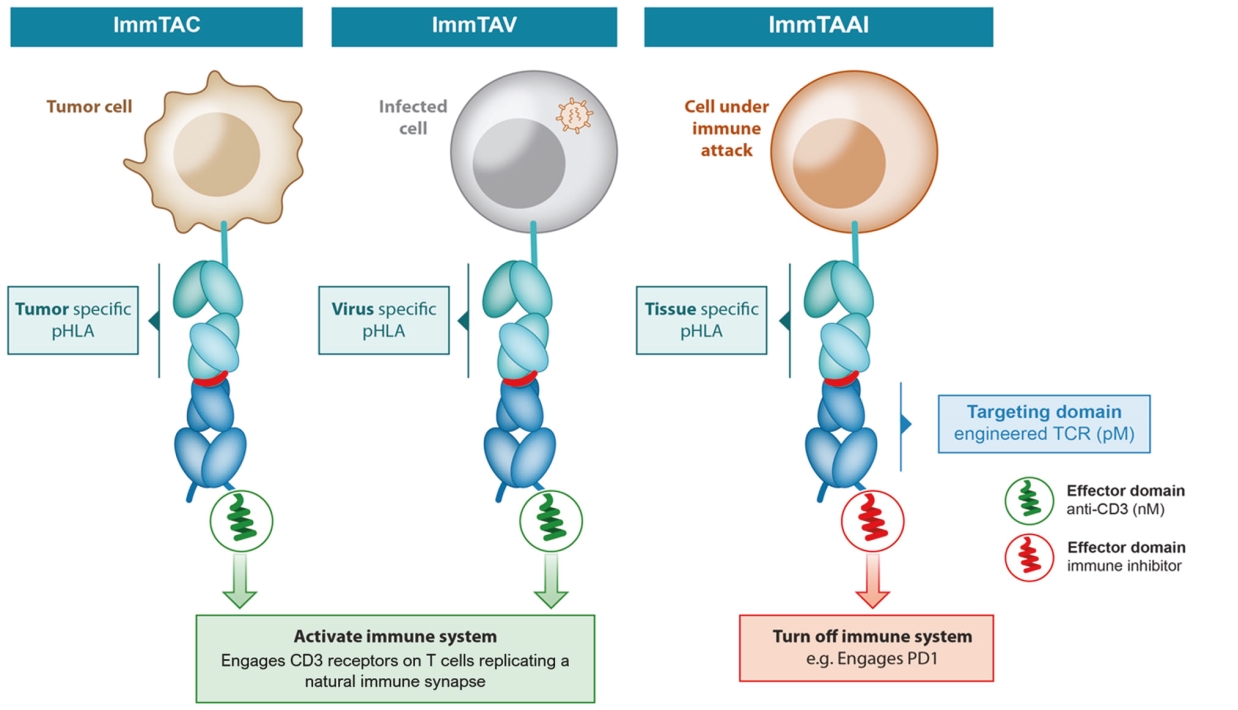

ImmTAV platform

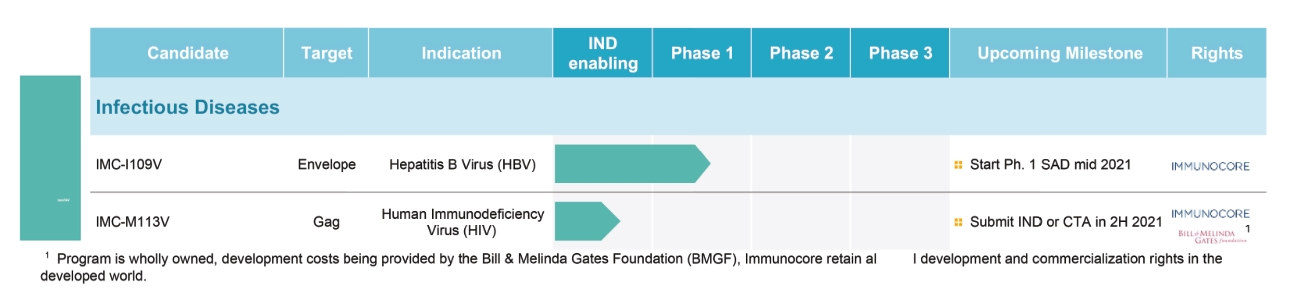

IMC-I109V clinical program

As of October 31, 2020, we own one pending composition of matter PCT patent application relating to our IMC-I109V clinical program. If granted, national applications derived from the PCT application are expected to expire in 2040, excluding any additional term for patent term adjustments or patent term extensions.

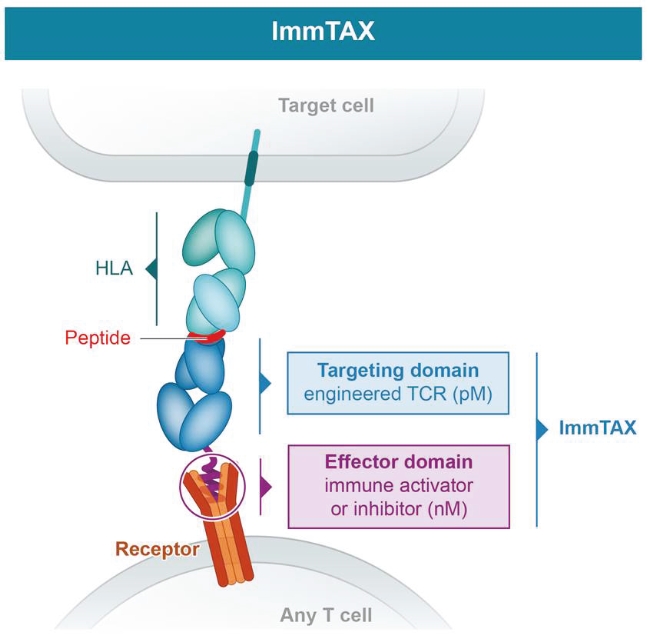

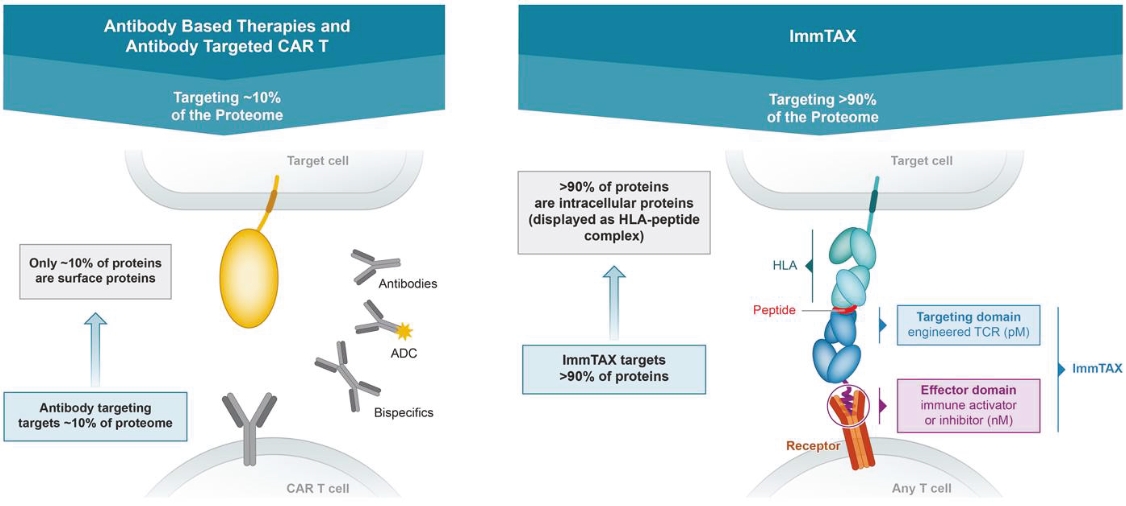

Our ImmTAX platform

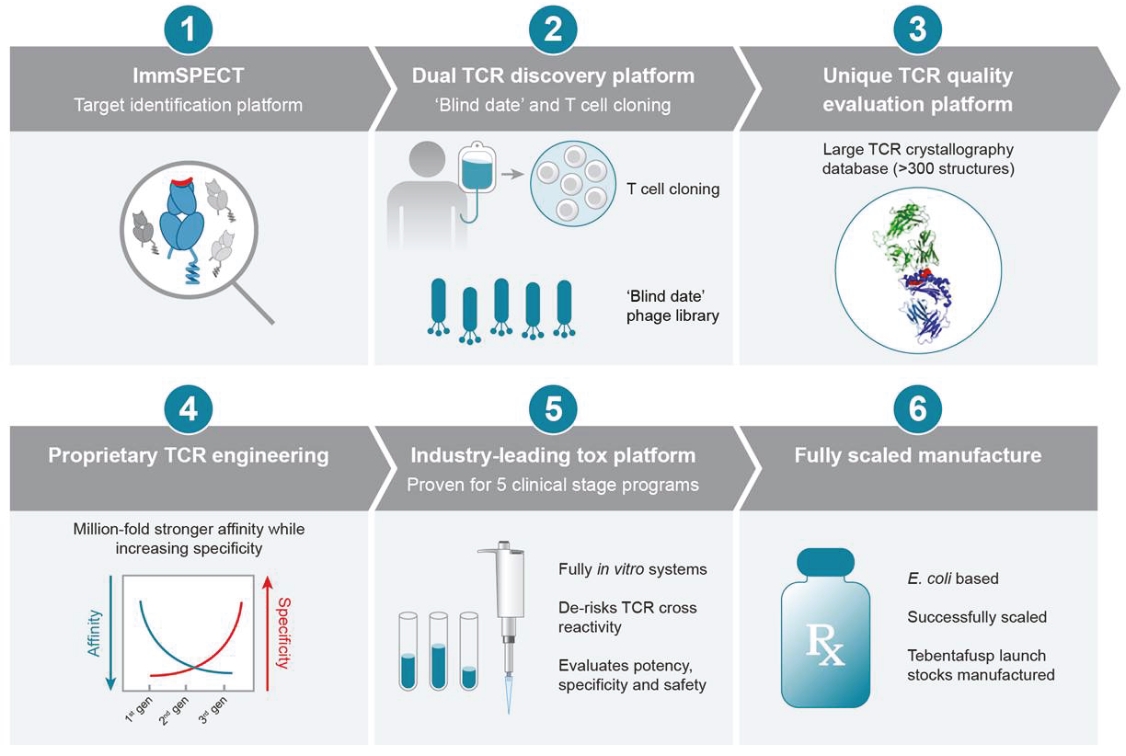

As of October 31, 2020, we own a number of patents and patent applications related to our ImmTAX platform. These include platform technology composition-of-matter patents and patent applications that aim to cover a disulphide bond stabilization approach for obtaining soluble TCRs, phage display methodology for the production of TCRs with supraphysiological affinity and specificity for target antigen, and a TCR bispecific format with potent T cell redirection activity. Granted patents for these core platform technologies have been obtained in major territories including nine issued patents in the United States and a 196 patents in a mixture of foreign jurisdictions, including Europe, Australia, Brazil, Canada, China, Eurasia, Hong Kong, Israel, India, Japan, South Korea, Norway, New Zealand, Mexico, Russia, Singapore and South Africa. The earliest of these patents will begin to expire in 2022 and 2023, for soluble TCRs with disulphide bond stabilization and phage display technology, respectively, excluding any additional term for patent term adjustments or patent term extensions. Patents relating to the TCR bispecific format required for enhanced potency will expire starting in 2030, excluding any additional term for patent term adjustments or patent term extensions.

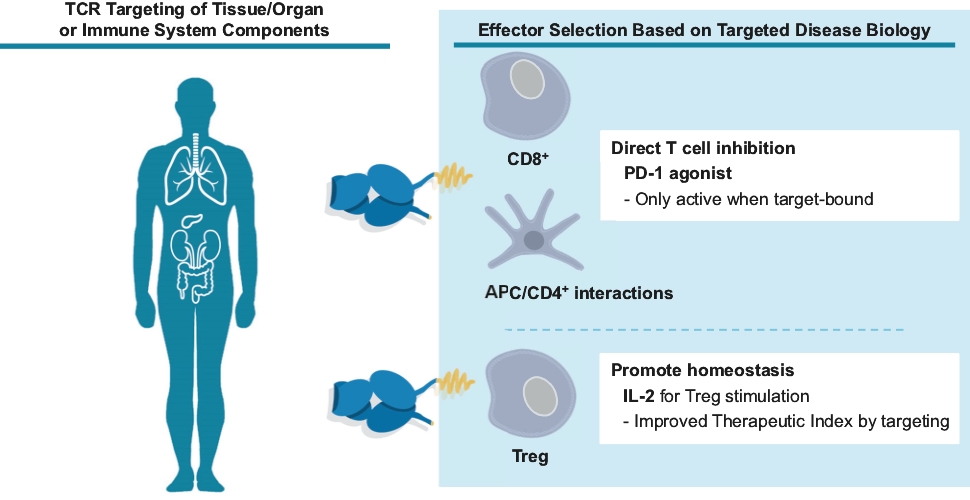

As of October 31, 2020, we own two pending composition-of-matter PCT platform technology patent applications relating to TCR bispecifics with improved therapeutic properties, including formats with extended in vivo half-life and improved anti-CD3 effector functions. We also own a pending composition-of-matter PCT patent application relating to a TCR-PD1 agonist bispecific platform for tissue/organ specific immunosuppression for the treatment of autoimmune and autoimmune indications. Any U.S. non-provisional patent applications or foreign patent applications timely filed based on these applications, if issued, would expire between 2039 and 2040, excluding any additional term for patent term adjustments or patent term extensions.

The platform patents and patent applications relating to soluble TCRs with disulphide bond stabilization and phage display methodology, as well as certain other technology patents, are jointly owned in 50% equal share